Why the UK should accelerate development of stablecoins

By Simon French, Chief Economist and Head of Research

Last week the Office for Budget Responsibility (OBR) published its latest update on the long-term outlook for the UK public finances. It was a sobering read. An ageing population, a rapidly changing climate, and the costs of maintaining the nation’s infrastructure are going to put strain on the UK budget for decades to come.

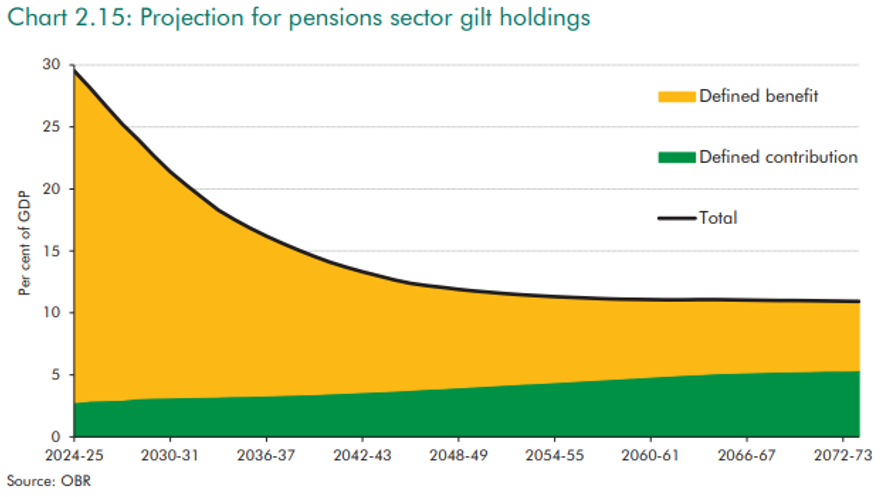

For a British electorate fatigued from a near-twenty-year period of spending restraint and tax increases there is little light at the end of the tunnel. But within the OBR’s ‘Fiscal risks and sustainability report’ one chart really took my breath away. It projected that total demand for UK government debt - Gilts - amongst UK pension schemes is set to fall from 30% of GDP (approximately £1 trillion) to just 11% of GDP by 2050. Half this fall in demand for Gilts will happen over just the next five years. This comes as final salary pension schemes decline in significance and reduce their need to own assets, like Gilts, that match the pensions they pay out.

This may seem a dry and obscure issue given everything else that is going on in the UK economy, but this shift in demand for Gilts has huge implications for the cost of servicing the UK’s national debt. If fewer pension schemes see the need to own Gilts, then the prices for this form of debt remain depressed, and interest rates remain high. The net result will be the amount of UK tax revenue needed to service existing (and future) debts will rise. In doing so this will divert resources away from education, health and other crucial public services. For a government adding to the national debt at a rate of more than £100bn a year that is a huge problem.

So what can be done? Well, the government is already pressuring UK pension schemes to invest more in assets like infrastructure and private companies - so mandating them to also own more UK Gilts would have its pension policy running at cross purposes. It would also amplify existing investor fears of financial repression. Reducing the debt and levels of Gilt issuance looks harder still given the current rebellious state of Labour backbenchers. More innovative solutions may be necessary. Could more widespread use of UK digital assets, specifically stablecoins, provide part of the answer?

In the evolving landscape of digital finance, stablecoins - specifically digital currencies whose value is pegged to low risk financial assets like short-term government debt, or cash - have emerged as a promising innovation. For the UK, developing a national framework and infrastructure for stablecoins presents an opportunity not just to modernise its financial system, and to assert leadership in the global digital economy, but also catalyse demand for (relatively) safe assets like its own sovereign debt. At a time when the US is racing ahead in this arena – recognising the importance of retaining demand for US Dollar-denominated assets - the UK risks being left behind.

US Treasury Secretary, Scott Bessent, who is arguably the financial services grown-up in President Trump’s team, has made passing stablecoin legislation a key priority. The GENIUS Act currently in the US House of Representatives is expected to be passed into law shortly. That Act will provide greater regulatory clarity for firms looking to issue stablecoins backed by US dollar assets. The Circle Internet Company - the issuer of one of the most widely used stablecoins , USDC – has seen its share price soar 500% since its debut on the Nasdaq last month. These moves illustrate both investor enthusiasm for digital currencies, but also at its heart the US government’s concerns that demand for its own sovereign debt needs buttressing through digital innovation. In the Wild West of non-asset-backed cryptoassets, stablecoins may just be the sheriffs.

Turning back to the UK, it has long been a global financial hub. However, maintaining this position in the twenty-first century will require embracing digital transformation. Stablecoins represent a disruptive evolution of currency that merges the stability of fiat with the flexibility and programmability of blockchain technology. The risk of disintermediation of Sterling-based assets - both Gilts and the Pound - is a real and present danger for a government and central bank slow to adjust to the fact that UK assets are no longer things that international investors have to own.

In The Times today, the Bank of England Governor, Andrew Bailey, has indicated unease at promoting stablecoins in the UK - citing risks to the transmission of monetary policy and financial stability risks. The Governor, in my view, risks being overtaken by global events outside his control and thus making the job of maintaining Sterling asset relevance even harder. Bailey’s proposal for tokenised reserves risks tying the UK’s digital currency strategy to its domestic banking system, rather than grasping the opportunity for global relevance. Should UK asset-backed stablecoins become an integral part of payments and settlement systems around the world - particularly amongst nations worried about more confrontational US economic policy - the Bank of England can support the government in maintaining demand for UK debt. It will be interesting to observe any differences between the Governor’s view on stablecoins and that of the Chancellor, Rachel Reeves, at this week’s Mansion House dinner speeches.

Digital finance is becoming a geopolitical race. Countries like the United States, China, Singapore, and the European Union are rapidly exploring or deploying their own stablecoin or central bank digital currency (CBDC) projects. The UK cannot afford to lag behind in this global trend.

A parallel challenge for advanced economies like the UK is ensuring financial services are accessible to all citizens. Despite being a highly developed country, the UK still has a population segment that is either unbanked or underbanked - individuals who may not qualify for traditional banking services or live in areas underserved by financial institutions. The accelerating closure of High Street banks and declining use of cash has raised the issue of financial inclusion up the UK political agenda. Stablecoins, especially those built on public blockchains, can be accessed via smartphones and internet connectivity, removing many barriers associated with traditional banking. Individuals without access to a bank account could hold, transfer, and spend stablecoins with minimal setup and cost. This could empower marginalized communities, gig economy workers, and small businesses by providing them with reliable digital payment tools.

The UK has an opportunity to lead by example: promoting innovation while safeguarding its financial stability. As the world transitions to a more digital and decentralized financial future, stablecoins offer the UK a powerful tool to stay competitive, resilient, and inclusive. But without a clear regulatory roadmap then stablecoins also providing an answer to the Chancellor’s growing fiscal problems will be an expensive missed opportunity.