On this page

Service delivered consistently by knowledgeable, trusted people

Companies receive thoughtful advice and commentary from our experienced staff. Institutional investors hunting for ideas get direct access to our seasoned sales team and research analysts. Traders wanting high or low-touch execution from multiple venues, with proper performance benchmarking, deal with us daily.

Panmure Liberum have raised an aggregate £9.9 billion of equity over the last five years, introduced private and institutional money to corporate and investment fund opportunities and brought North American investors into British businesses*.

*when aggregating the services and activities of Panmure Gordon (UK) Limited with those of Liberum Capital Limited over the relevant period.

Panmure Liberum Research

Our team of analysts are experts in their respective fields and maintain constant contact with both companies and institutions to keep on top of the issues that matter most.

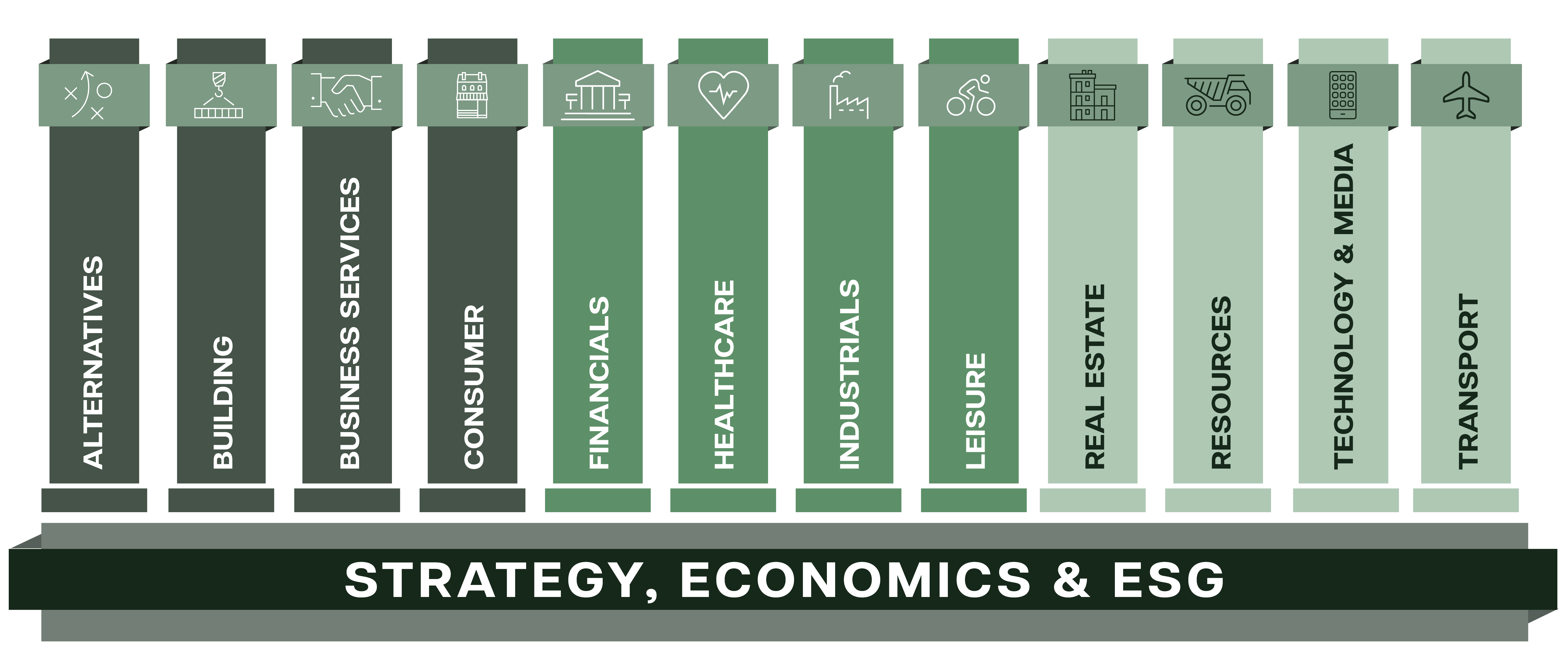

We produce All-Cap Pan-European Equity Research across twelve pillars of excellence in the UK and Continental Europe. We believe that our All-Cap model facilitates read-across, and a greater depth of sector knowledge. Our entrepreneurial environment drives independent thinking at a macroeconomic and political level, enabling our specialist analysts to identify fresh data points and deliver unique insights.

Our team cover our twelve pillars of excellence, comprising Alternatives, Building, Business Services, Consumer, Financials, Healthcare, Industrials, Leisure, Real Estate, Resources, Technology & Media and Transport with an overlay from SEE (Strategy, Economics and ESG).

Research partnerships

Systematic analysis and over 120 additional stocks covered via our research partners.

- Panmure Liberum SAM (in collaboration with Systematic Analysis Limited) - a systematic investment analysis approach covering around 2,000 companies in Europe and the United States. Combining revisions momentum with operating momentum and valuation tools, it is designed to help investors outperform by generating investment ideas that reflect opportunity and risk

- Agency Partners LLP - over 20 global Aerospace and Defence companies

- Research Partners AG - over 100 Swiss companies

Research in numbers

Panmure Liberum Sales

Our highly experienced sales team is based in both London and New York. We pride ourselves on the relationships we have built with fund managers on both sides of the Atlantic.

Years of experience and relationship-building mean our trusted sales team speaks daily with the full spectrum of institutional investors who want only actionable ideas relevant to them. Our goal is to help them outperform the market. We focus on cash equities.

We work closely with a diversified range of top-quality corporate clients. The breadth of our distribution and the depth of our relationships with the key investors form the bedrock for IPOs, equity raisings for listed companies and block trades.

Distribution partnerships

We offer broader and deeper distribution capabilities via our valued partners.

- CGSI - Asia

- Raymond James - Continental Europe

Accessing over 2,000 institutions worldwide, benefitting our clients by opening up new geographies and accessing new pools of capital

Sales in numbers

Execution and Market Making

We passionately believe in offering a high quality and professional Execution service. Our experienced team have quantitative and qualitative tools at their disposal, combined with a wealth of experience and a focus on excellence and integrity. This allows Panmure Liberum to provide a best-in-class range of services across equities, investment funds and ETFs. Our progressive attitude to facilitation sees long-established institutional relationships overlaid with the latest technology.

Electronic Trading

T-REX encompasses a proprietary suite of benchmark, liquidity seeking algorithms underpinned by a consultative execution team. Paired with our pre/post-trade capabilities we seek to optimize client performance and minimise market impact in agency only workflows. Our consultative approach enables us to connect with our clients and deliver tailored solutions within the electronic trading landscape.

We offer unique retail liquidity sourced via our TREXCORE and A-PEX algorithms, built in conjunction with Turquoise (LSE), this gives our institutional clients access to meaningful multi-cap and retail liquidity on a global basis. T-REX algorithms provide access to more than 50 dark pools, SI’s, periodic auctions, conditional venues, and primary exchanges. The flagship liquidity seeking algorithms TREXCORE and A-PEX, combine both dark and lit attributes to prioritise price sensitivity and allow for advantageous dark order placement. This includes optimal behaviour to manage market impact and opportunity risk.

Sales Trading

The Panmure Liberum sales trading team has a broad, well-established distribution network across the UK, US, Europe and Asia.

Our internal prospecting tools, liquidity provision, thematic trading product and IOI analytics are just some of the tools that we use to enhance our execution and increase our probability of matching business.

This enables our clients access to flow and block liquidity from a diverse investor universe including institutional long-only funds, boutique and regional asset managers, hedge funds, pension funds, sovereign wealth funds and registrars.

Market Making

Our market making team is committed to providing liquidity for our clients. We pride ourselves on having a strong market share in our corporate broking stocks and actively provide liquidity in over 720 names. This is aided by our multi-channel market access including algorithmic strategies, dark pools, direct-to-exchange, electronic retail investor networks (RSP), MTFs and internal liquidity.

Investment Funds

Our execution and sales team consists of highly experienced market makers and sales traders, who provide liquidity and specialised execution services in Investment Funds and VCTs.

Our long-standing relationships cover Corporate, Institutional, Private Wealth and all direct Retail Clients (RSP), and our platform enables Panmure Liberum to access liquidity across multiple venues, offering a best-in-class execution service.

Panmure Liberum acted as Sole Debt Advisor to Sirius Real Estate Limited to secure a €150m revolving credit facility

Jun 2025 News

Panmure Liberum appointed Sole Corporate Broker and AQSE Corporate Adviser to Shepherd Neame Ltd

Jun 2025 News

Panmure Liberum advised Keltbray on the raising of £30m of working capital facilities provided by Metro Bank

Jun 2025 News