Thought of the Week - Taxes and happiness

It is early April and here in the UK, a new tax year has begun. And that means that soon, we will all be thinking about filling out our tax returns, though most people will inevitably delay it as far in the future as possible. Nobody likes to pay taxes and we all could do with less than what we pay today.

Yet, if you ask people how unhappy they would be if income taxes were increased, most people vastly overestimate the negative impact higher taxes would have on their happiness. It is a little bit like asking people how unhappy they think they would be if they had an accident that paralysed them. Most people would think they’d be desperately unhappy, but if you ask real-life paraplegics, it turns out there is no difference in their general level of happiness before and after their accidents.

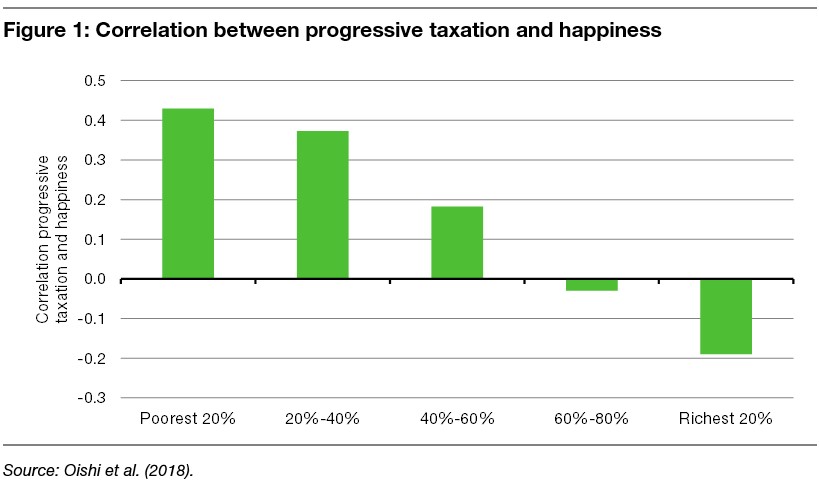

This brings me back to taxes (not that taxes are a paralysing accident, though). A 2018 study of individuals in the United States investigated the relationship between income taxation, income inequality, and happiness. The study focused mostly on progressive taxation and its correlation with happiness and found that in a more progressive tax system where higher income groups are taxed more aggressively, there is a similar difference between perception and reality. If you ask people of all incomes if a more progressive tax system would make low-income households happy, everybody said yes. And indeed, poor households experience significantly higher levels of happiness in a more progressive tax system.

However, if you asked people of all incomes if a more progressive tax system would make high-income households less happy, everybody said yes. Yet, if you actually measured the happiness of the 20% of households with the highest income, it did decline marginally, but the decline was not statistically significant. In fact, if you waited five years, the rich were just as happy in a progressive tax system as they were in a less progressive system, while the poor were materially happier.

What seems to be at play here is what Robert Frank calls “the mother of all cognitive illusions”. When we think of ourselves as having to pay more taxes, we think of our income today and then imagine we have to pay more taxes to end up with lower income tomorrow. That is the correct perception if we think about losing money with investments or because we are being robbed. But if we are being “robbed” by the government in the form of taxes, it’s not just us who have less. Everyone who has a similar income to us will lose a similar amount. We all get poorer at the same time and by roughly the same amount.

Hence, when we think about higher taxes, we ignore the fact that relative to our peers we are not getting worse off. And what matters for our happiness is not our absolute level of wealth or income, but our status relative to others. Think about it in the way Frank describes: If high-income households all have to pay more taxes, they won’t be able to afford a Ferrari anymore and may have to downgrade to a Porsche. But because everybody has to downgrade to a Porsche, you are still driving the best car on the road. The difference is just that in a world of low taxes you can buy a Ferrari but due to a lack of infrastructure investments by the government, you couldn’t drive it because the roads are in disrepair. In a world of higher taxes, on the other hand, you have a Porsche and can drive it on a smooth road.

What would you prefer? And before you complain that this is a contrived example, let me tell you that when I was working on a project in Saudi Arabia, one of the executives of the company I worked for told me that he once bought himself a Ferrari. He decided to give it back after a few months because he said he couldn’t drive it because the roads in Saudi Arabia were so bad. So now he has a Mercedes SUV.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.