Thought of the Week - To make a profit, you need to get two decisions right

People who have known me for a while know that I am a big fan of infrastructure investments. In particular, I like direct infrastructure investments, both green and traditional. Before I moved to the UK, I did not know about the large number of listed infrastructure funds in the UK that allow investors with every budget to invest in this asset class. Without endorsing any specific fund and reminding everyone to do their due diligence before investing, you can get an overview of the listed closed-end funds in the infrastructure and renewable energy space on the homepage of the AIC.

Investors also need to be aware though that infrastructure investments are not as straightforward as they might think. One of the most common reasons why investors want to get a hold of infrastructure assets is because they promise stable cash flows that are often linked to inflation. And in a yield-starved world, getting a stable dividend of 5% or more is indeed very tempting.

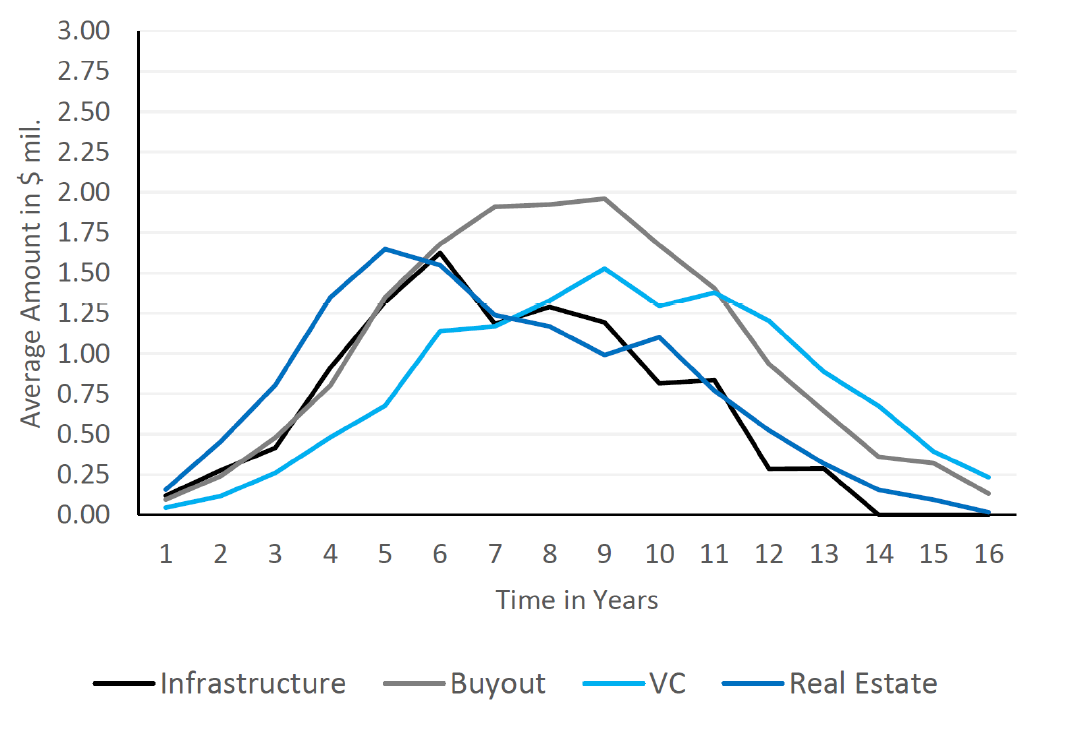

But when you look at the actual performance of closed-end funds and direct infrastructure investments, their cash flows look anything but stable and in fact bear more of a resemblance to the cash flows of traditional private equity and direct real estate funds.

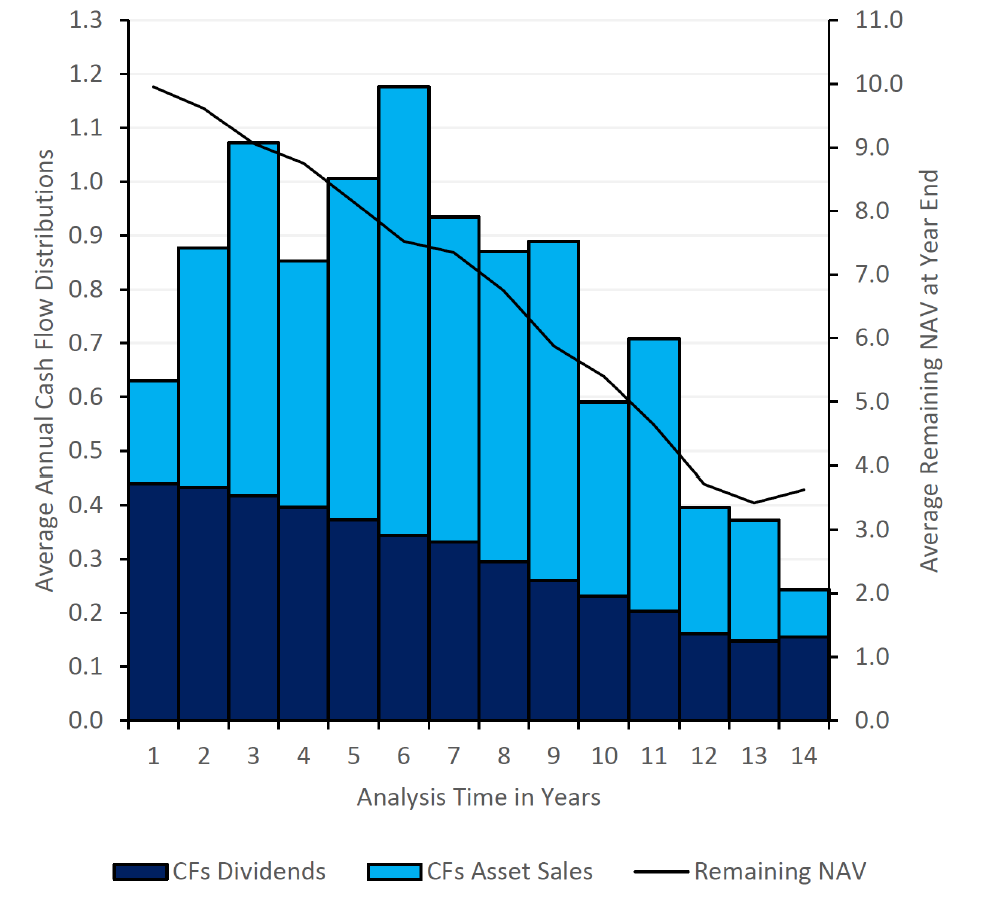

A new research paper explains why. The underlying cash flows from the infrastructure assets are indeed very stable, but they only make up a small part of the total cash flows of the investment. The bulk of the cash flow is generated by selling existing assets and distributing the proceeds to investors, just like a private equity or venture cap fund would do.

In fact, the main explanatory variable for the difference in performance between a top quartile and a bottom quartile infrastructure fund is how well the asset manager is able to exit an investment at a profit within the first five years of the fund’s life.

As they say in investing, a successful investment requires two good decisions: when to buy and when to sell. Until now, the decision to sell has been generally quite easy to make. As more and more investors increased their exposure to infrastructure investments, there were plenty of buyers for existing assets. Exits were easy and sale prices were high. But as the asset class matures, less and less new money will flow into it and exits will become harder to achieve profitably – especially if you paid too much for an asset when you bought it. This will mean that returns for infrastructure funds will likely decline over time, just as they did for private equity and venture capital. As such, it will become more and more important for investors to do their due diligence and invest in high-quality asset managers that don’t overpay for assets.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.