Thought of the Week - What happens if China sneezes?

There is a lot of truth in the saying ‘if the US sneezes, the rest of the world catches a cold’. Today, with the Chinese economy roughly on par with the US in terms of output, does the rest of the world also have to fear a sneezing Chinese panda?

An interesting study by the European Central Bank has tried to compare the impact of Chinese monetary policy and macro events on global equities, exchange rates, and commodity prices. Crucially, they took extra care to disentangle the impact of a potential US shock or a change in global risk aversion from the Chinese shock. This isn’t as easy as it sounds because most of the time, weak Chinese macro data coincides with weak US macro data or a global change in risk aversion.

I won’t bother you with the statistical details of the methodology and instead show you two key results.

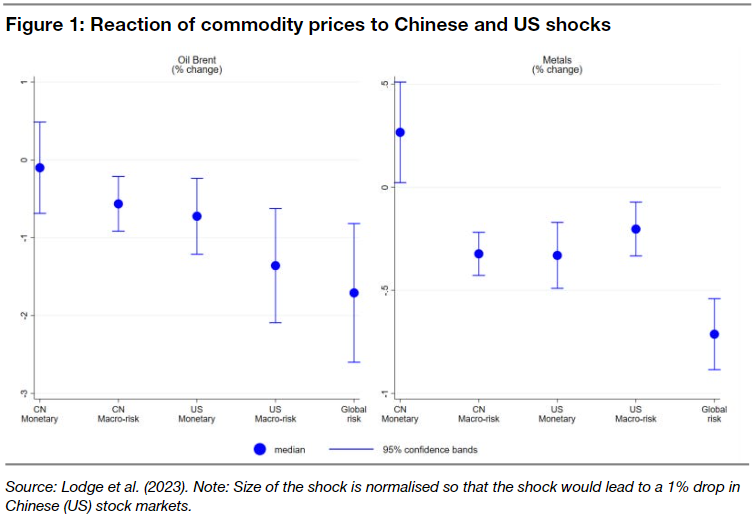

As we might guess, commodity prices are about as sensitive to shocks in China as shocks in the US. The chart below shows the median reaction of oil and metals prices to a macroeconomic or monetary policy development that triggers a 1% drop in local equities.

For example, a Chinese macro shock that would lead to a 1% drop in Chinese equities on average leads to a 0.5% drop in Brent crude oil prices (second bar from the left in the left chart). Meanwhile, a US macro shock that leads to a 1% drop in US equities on average leads to a 1.4% drop in Brent crude oil prices (second bar from the right in the right chart). And a global macro shock that would lead to a 1% drop in US equities leads, on average, to a 1.75% drop in Brent crude oil prices.

Looking at the charts, we can see that for industrial metals, Chinese macro developments are as important to prices as US macro developments or changes in US monetary policy. For crude oil, US macro developments are still about twice as important as Chinese macro shocks, but Chinese macro shocks can at least compete with changes in US monetary policy. In other words, for commodities, China matters because it is such a large consumer of both oil and metals.

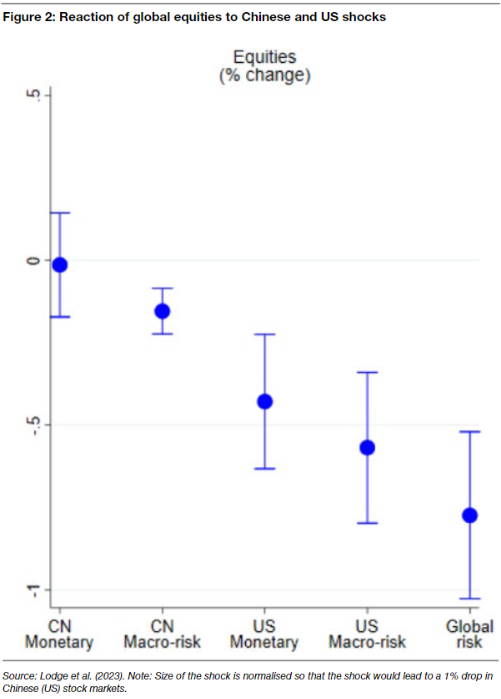

But what about global equities? After all, China is increasingly linked to global trade and the global economy. The chart below shows the estimated reaction of global equities to local Chinese and US shocks, as well as a global increase in risk aversion. Note that global equity markets are much less sensitive to developments in China. The macro shock in China needs to be about four times larger than a similar macro shock in the US to create the same reaction in global stock markets. This is at the same time comforting and worrisome.

It is comforting because it means that we need not be worried if the Chinese economy goes into recession or has an extended period of low growth. After all, the impact on global equities tends to be much smaller than a US recession. But it is worrisome as well, because if the shock in the Chinese economy is large enough, China can derail global equity markets. And given the current crisis in the Chinese real estate market, it means that if the Chinese government can control the situation, we don’t have to worry about anything. But if the Chinese property market gets out of control and drops like a stone, then we need to run for the hills. We can no longer ignore China as an influence on global equity markets.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.