Retail investors and earnings surprises

On average, retail investors aren’t the smart money in the market. They tend to trade on noise and, in some cases, they may trade against fundamental information, creating systematic market mispricing and opportunities for ‘smarter’ investors.

One such systematic opportunity that is made worse by retail investors seems to be the post-earnings announcement drift. A new study by researchers from Harvard, the Chicago Fed, and Farallon Capital Management presents evidence that retail investors, on average, act as short-term contrarian investors for momentum and earnings surprises, thus reducing the efficiency of markets in incorporating fundamental news.

To recall, post-earnings announcement drift is the observation that earnings surprises don’t get fully incorporated into share prices on the day of the announcement. Instead, companies with positive earnings surprises tend to see their share prices drift higher in the weeks and months after the announcement, especially when they are trading close to their 52-week highs. Similarly, companies with negative earnings surprises tend to see their share prices drift lower for weeks and months after the announcement as the bad news is incorporated into the share price only slowly.

The new study confirms this effect once again and traces it back to retail investor flows. To do this, the study looked at the net retail flows relative to the previous quarter's average in and out of stocks and split them between stocks with high and low earnings surprises as well as high and low price momentum.

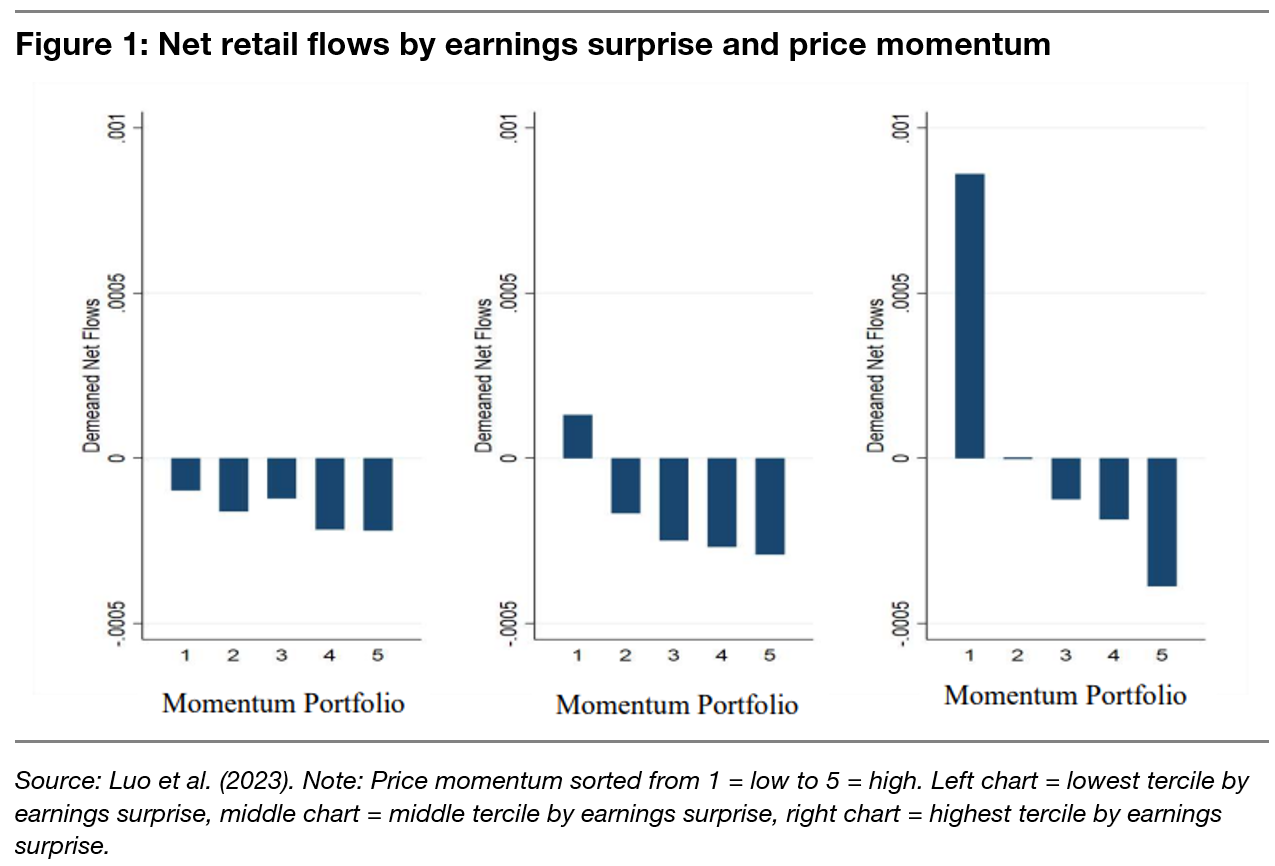

My first chart shows the net retail flows into stocks with different price momentum, with ‘1’ denoting the stocks with the weakest price momentum and ‘5’ denoting those with the strongest price momentum. The chart on the left shows the stocks with the lowest earnings surprise, while the chart on the right shows the stocks with the highest earnings surprise.

Note that, on average, retail investors are buying into stocks with low price momentum and selling stocks with high price momentum, but this effect gets stronger the larger the earnings surprise is. In other words, retail investors predominantly tend to buy stocks with low price momentum and large earnings surprises (i.e. they are hoping that the positive surprise indicates a reversal of fortunes for the company) and tend to sell stocks with strong price momentum and large earnings surprises (i.e. they sell on good news for stocks that have gone up in price a lot).

This means that shares with large earnings surprises and weak price momentum underreact to negative earnings surprises but overreact to positive earnings surprises. Meanwhile, those with strong price momentum underreact to positive earnings surprises and overreact to negative earnings surprises.

That is exactly the opposite of what should happen in a rational market. The result is that negative earnings surprises do not get incorporated fully for underperforming stocks and neither do positive earnings surprises for outperforming stocks. In the weeks and months that follow the first price reaction, the market then ‘corrects’ this mispricing, which leads to stocks with positive earnings surprises and strong price momentum drifting higher while those with negative earnings surprises and weak price momentum drift lower.

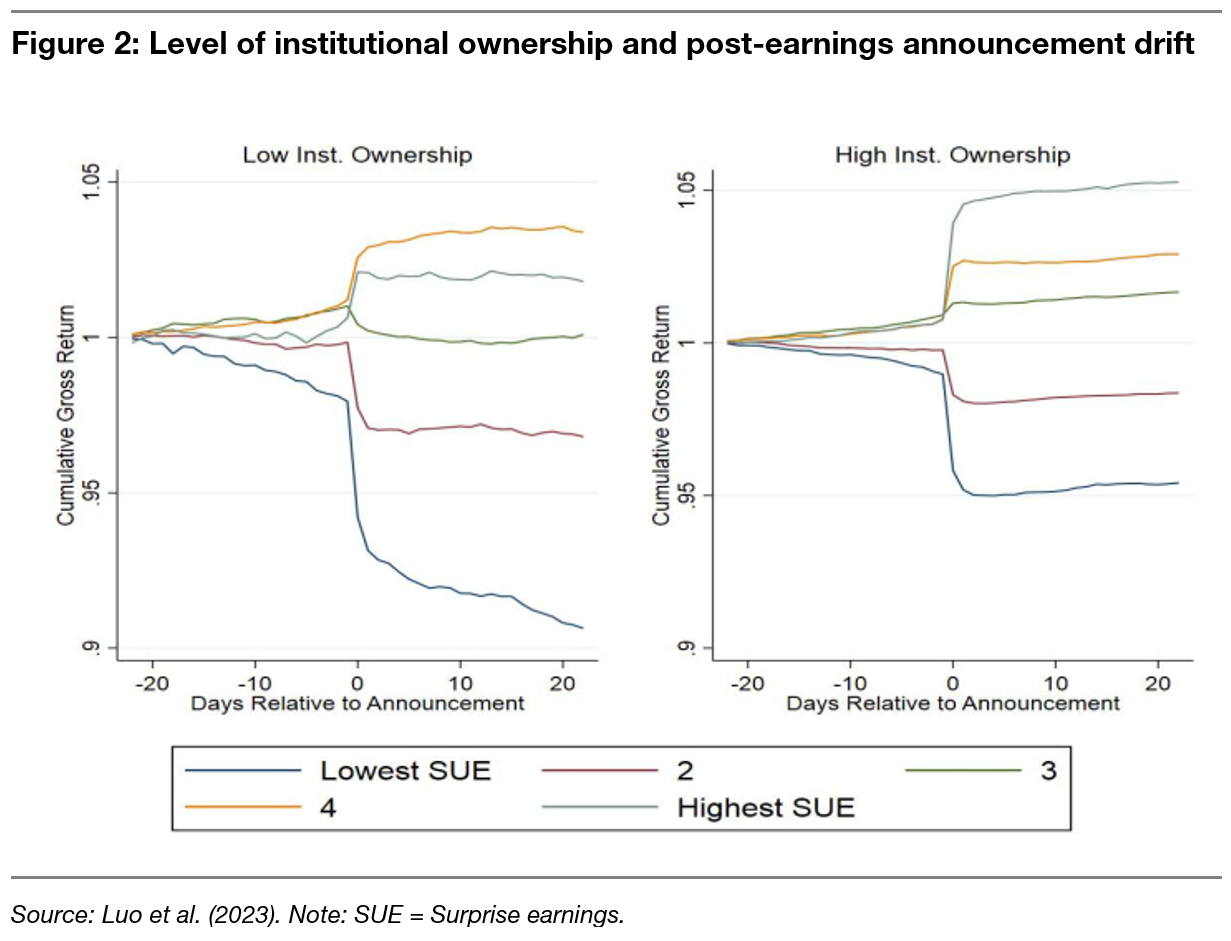

That retail investors are a key driver of this post-earnings announcement drift can be seen in the chart below, which shows the drift for companies with high and low institutional ownership.

Stocks with low institutional ownership, where retail investors exert greater influence on the share price, show a significant downtrend on stocks with negative surprises in the days and weeks after the announcement and a small but measurable uptrend for stocks with high earnings surprises. Meanwhile, stocks with high institutional ownership show much less post-earnings announcement drift. In particular, the stocks with the lowest earnings surprise and high institutional ownership show no negative post-earnings announcement drift.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.