Thought of the Week - Winning the global loser’s game

Charlie Ellis pointed out in his famous book “Winning the Loser's Game” that one of the best ways to outperform the market in the ‘investment game’ is not to pick winners but to avoid the losers, i.e. assets that drop sharply in price.

Charlie wrote this advice for individual investors, but it works well for professional fund managers too, as a new study on the country rotation of global equity funds shows. The study examined the country exposure of actively managed global equity funds and sorted the funds by the turnover rate in the country allocation. The main result was that funds with higher country rotation outperformed funds with a more static country allocation. This is not as surprising as it may sound and is very much aligned with the observation that, on average, high-turnover funds outperform lower-turnover funds after fees.

What is interesting, though, is how funds with higher turnover in their country allocation manage to outperform. It wasn’t that these funds were able to pick the countries with stronger performance. No, they were better able to spot countries that got into trouble and reacted quickly to reduce their exposure, even if the stocks in these countries were global stocks. When a country gets into trouble (be it a recession or some exogenous event), all stocks in that country suffer.

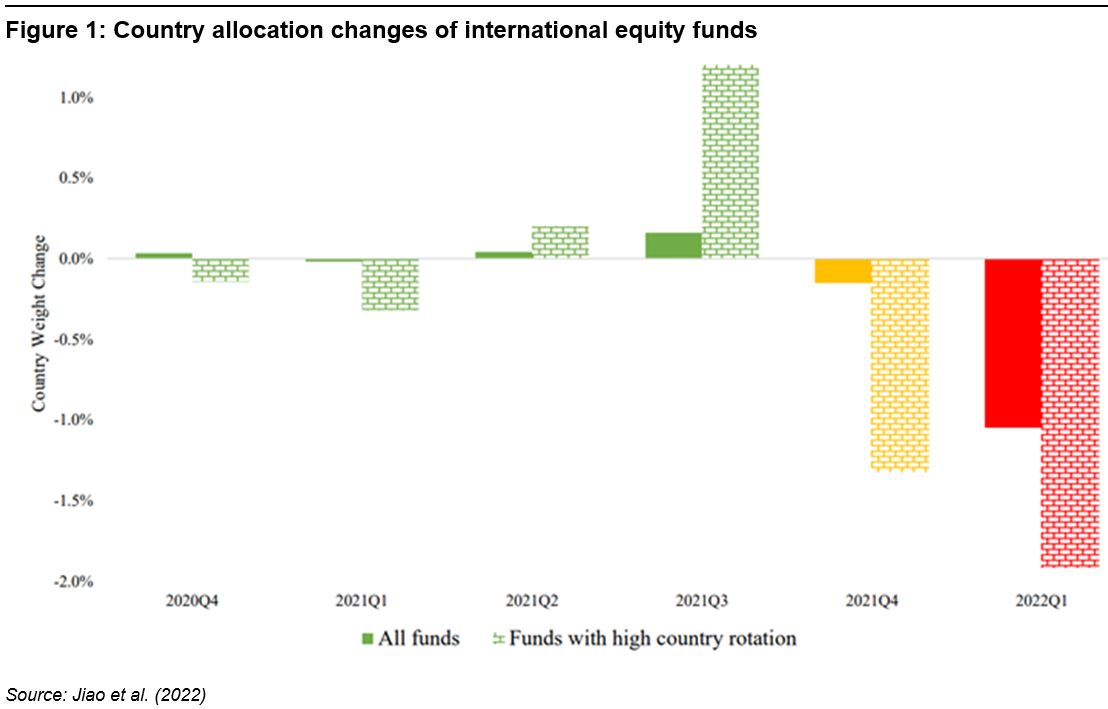

One extreme case study was provided by the Russian invasion of Ukraine. Funds with high country turnover reduced their allocation to Russia before the invasion and further reduced it after the war had begun. The average fund, meanwhile, did not reduce exposure to Russian stocks before the invasion and only sold those stocks once the damage to the portfolio had been done.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.