Thought of the Week - I picked that stock, so it won’t go down

The other day, I wrote about evidence that when people get an ordinary object like a mug or a hat, are more likely to ask a higher price for it and are less likely to sell it at any price offered to them. This is the well-known endowment effect. But I also discussed how people who were asked to write a story about these mugs and how these objects are personally significant to them (even though they got a random mug and were asked to make things up) increased their value in the eyes of the people who told the story about these mugs by 25% to 80%, depending on the circumstances. This implies that stocks that people own are more highly valued by them than by people who don’t own the stock. Furthermore, if these stocks come with a great story (narrative), people will value them even more.

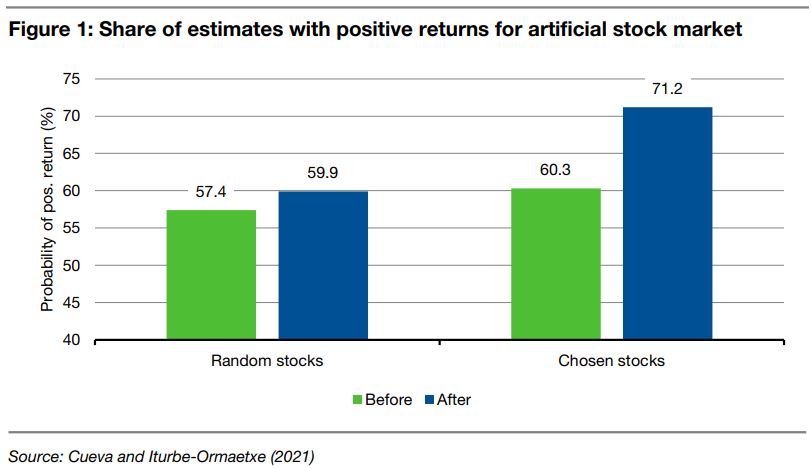

In an independent piece of research, two academics from the University of Alicante tested that in both the lab with an artificial stock market and real life with trendy glamour stocks. In the lab experiment, they gave each participant six artificial stocks to observe. The stocks had slightly different returns so over time their share prices would diverge. After ten periods, the participants were asked to estimate the return for the next ten periods of each of these socks. They were then either given three of these stocks at random, or the participants could choose three of the stocks they liked the most (and that they thought were most likely to have a positive return). The chart below shows that before the participants owned these stocks, in about 57% to 60% of the cases they thought that the stock would have a positive return. When they were randomly assigned some stock, these estimates remained stable, but when they could choose their own stock, the expectations for positive returns increased. Just because they actively picked those stocks, they thought they had to have a higher return, even though they did not think so before they chose these stocks.

But things got really interesting in the second experiment, where the same people were asked to guess the returns on six glamour stocks every day for the next day: Alibaba, Facebook, Uber, Netflix, Tesla and Zoom. After trying to predict daily returns for these six stocks for a month, they were then either assigned three of these stocks at random, or they could choose the three of these stocks that they liked best.

And while the people who were randomly assigned the stocks didn’t materially increase their return predictions, the people who could choose their favourite stocks afterwards increased their predicted returns from 4.1% to 6-6.5% per quarter. That is, by buying into these stocks, the return expectations increased by two-thirds. The study doesn’t say whether the effect would be smaller for more boring stocks without the glamour of a good story. But it does show that the effect of ownership of real stocks tends to distort the perception of investors to a similar degree as the ownership of a random mug in a lab experiment. And that is something we need to be aware of when we think about our own investments and why they should have a positive return or what the risks are. Chances are, when we pick the stocks ourselves, we tend to substantially underestimate their risks.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.