Thought of the Week - How much are green buildings worth?

One area where the added value of better environmental quality is out of the question is real estate. A wide range of studies indicate that green buildings can command higher prices and higher rents. Julian Zehner has now re-examined this finding for London property between 2010 and 2021.

Looking at 2,537 property sales and 2,907 rental transactions, not only could Zehner determine how big the premium is on green buildings in London, but he could also identify how big the premium is for different levels of the BREEAM standard.

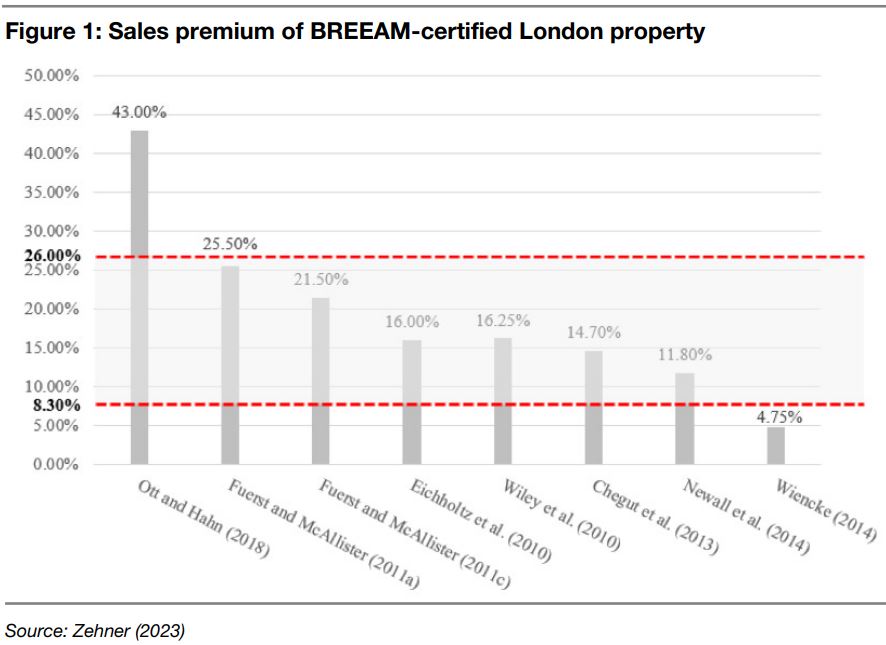

The chart shows the average premium on the sale prices of BREEAM-certified buildings in London compared to other buildings with similar characteristics (age, size, location, etc.). Depending on the method, he found an 8.3-26% premium for green buildings, which is roughly in line with the premia found by other studies.

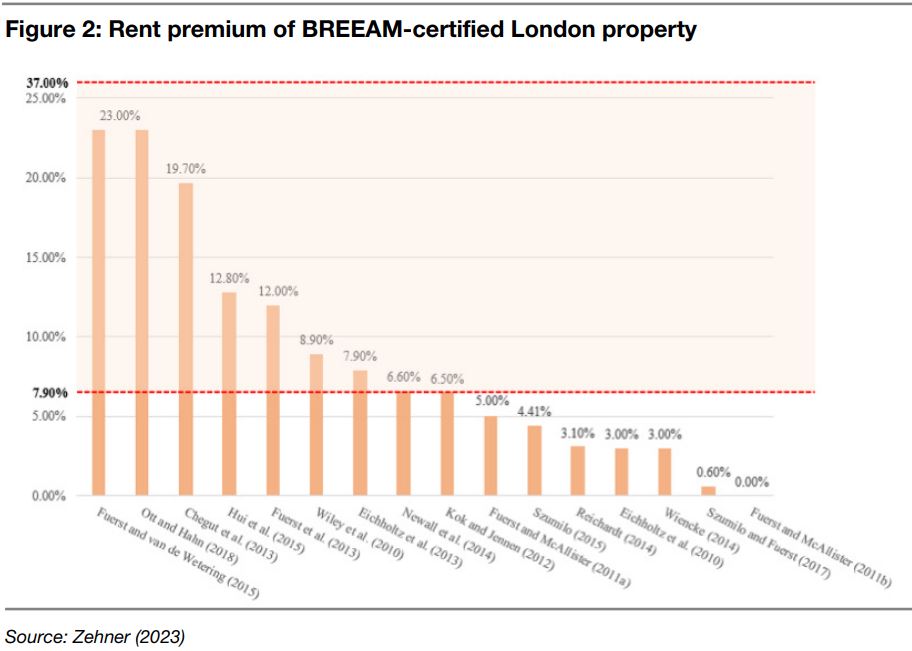

The key driver for these premium valuations is the higher rents that can be achieved. The chart below shows that in the case of London property, the premium on the rents achieved is somewhere between 7.9% and 37%. The upper end of these estimates is well above anything that has been documented in the previous literature.

Clearly, it pays to upgrade an existing property to achieve green certifications like BREEAM. Or to build new properties with high green standards. However, one thing should be kept in mind by property developers: It is not always better to aim for higher environmental standards.

In general, higher BREEAM certification standards were rewarded with higher rental premia and higher sales values, but there was hardly any difference between the highest BREEAM certification (‘Outstanding’ or five stars) and the second highest certification (‘Excellent’ or four stars). It seems as if tenants are unwilling to pay for additional green standards once a certain level of environmental standards has been met. In terms of value for money, a rating of ‘Excellent’ by BREEAM seems to be excellent indeed. Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.