Thought of the Week - The next time you complain about your taxes do this first

Everybody loves to complain about their taxes. But could you lower them? The Institute for Fiscal Studies has created a magnificent tool where you can play Chancellor of the Exchequer (Treasury Secretary of the UK for readers abroad) and try to come up with a long-term budget. Try it out, it will give you an idea of how difficult it is to be in charge.

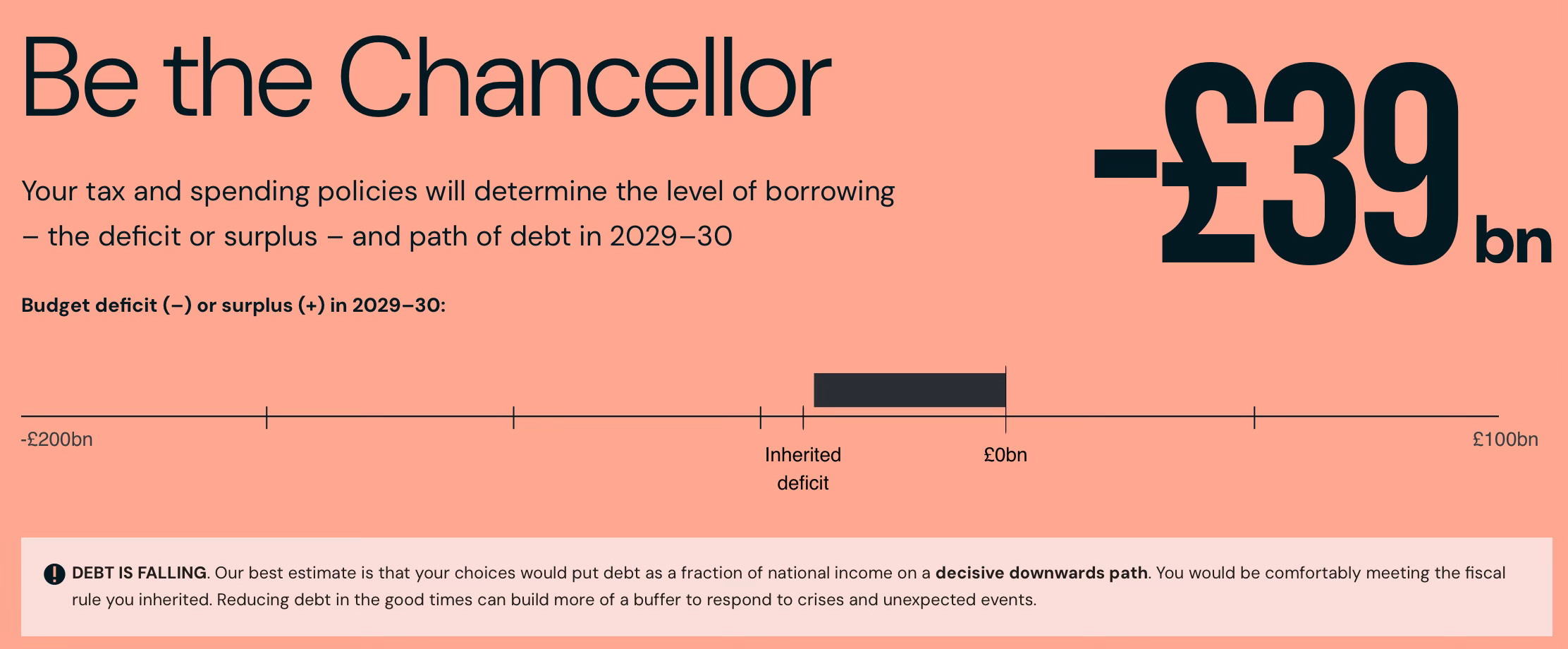

The tool allows you to adjust taxes and spending (within limits) and calculates the impact it has on government borrowing in five years. Hence it is a long-term spending plan for the five years after the upcoming general election in the UK. Here is what I came up with.

I managed to reduce borrowing in 2029/2030 from £41bn under current spending plans to £39bn, thus slightly reducing the debt and debt/GDP-ratio over the next five years. This was one of my goals since I think governments should try to reduce debt levels, but gradually, not suddenly.

How did I get there? First, let’s look at the spending side.

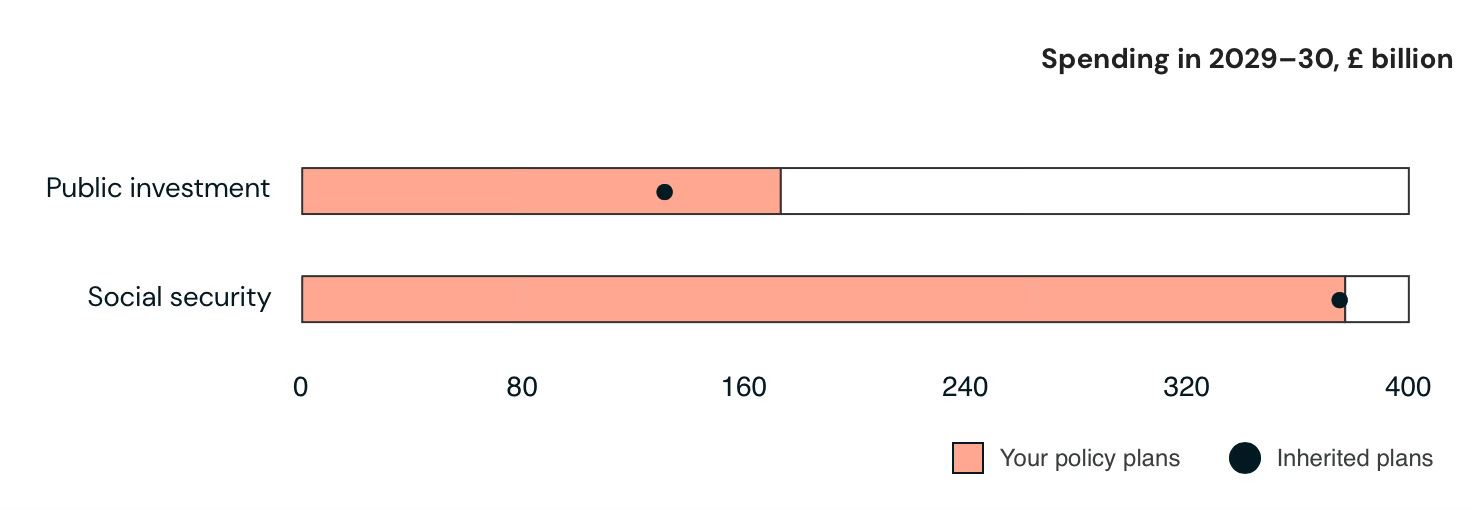

My key concern about the UK is that it has underinvested in infrastructure and other things for decades. The result is that we have leaking water pipes, horrible roads and train services, not enough nuclear and renewable energy, etc. So, the first thing I did was to increase government investment by 3% per year instead of keeping the public investment budget frozen in cash terms (and thus dropping in real terms creating even more underinvestment).

There is plenty of evidence that public investments have a fiscal multiplier >1 which means it increases GDP growth. And this is where the model of the IFS has its shortcomings. It does not calculate the growth effects of policy changes. So, I increased the real GDP growth assumptions from the 1.8% p.a. currently used by the Office for Budget Responsibility to 1.9% p.a.

A note to all readers: It is almost impossible to change trend growth in any meaningful way. So, pushing real GDP growth assumptions above 2.0% p.a. seems completely implausible given the demographic headwinds we face. Be reasonable when you make your assumptions.

After increasing government investments substantially, I also increased the spending on key departments that are under severe strain. Currently, the government plans to increase spending on healthcare by 3.1% per year to increase funding for the NHS and keep the share of the budget spent on defence constant, which means that defence spending increases by 1.8% per year in real terms. Most other departments have their budgets frozen at current levels, which effectively means they are facing a 3% annual decline in spending due to inflation.

What I did was to lift the spending on the key departments to 3% growth in real terms per year. These are healthcare, defence (thus spending more on defence than under current plans), education, and justice (in particular spending more money on prisons where we have a severe shortage in the UK).

Furthermore, I wanted to keep spending on several other departments at current levels as a share of the total budget (so no additional cuts from current levels). These are transport (other than investments in transport infrastructure), HMRC (our tax office so people cannot evade taxes that easily), grants to local governments and the Foreign Office as a means of projecting soft power in an increasingly unstable geopolitical situation.

This still leaves me with severe cuts in the Home Office, the Department of Work and Pensions, Housing, Agriculture and Environment.

I would make two changes in social welfare. First, I would withdraw the triple lock on government pensions, but the system doesn’t allow me to do that, so instead I reduce state pension by £20 per week. Or £1,100 per year. Second, I would allow people with lower incomes to claim child benefits even if they have more than two children. I do this for the following reason. Having children is one of the main causes for drifting into poverty and claiming other welfare payments like Universal Credit in this country, so child benefits are a first line of defence to reduce other welfare spending, in my view. And lest you argue that this just incentivizes poor people to have more children, think about the size of our child benefit. It is £16.95 per child per week. Not even enough to feed them.

The result is that I increase spending compared to current government plans by £67bn.

Ok, that was easy. Now to the hard part. How do I pay for all this?

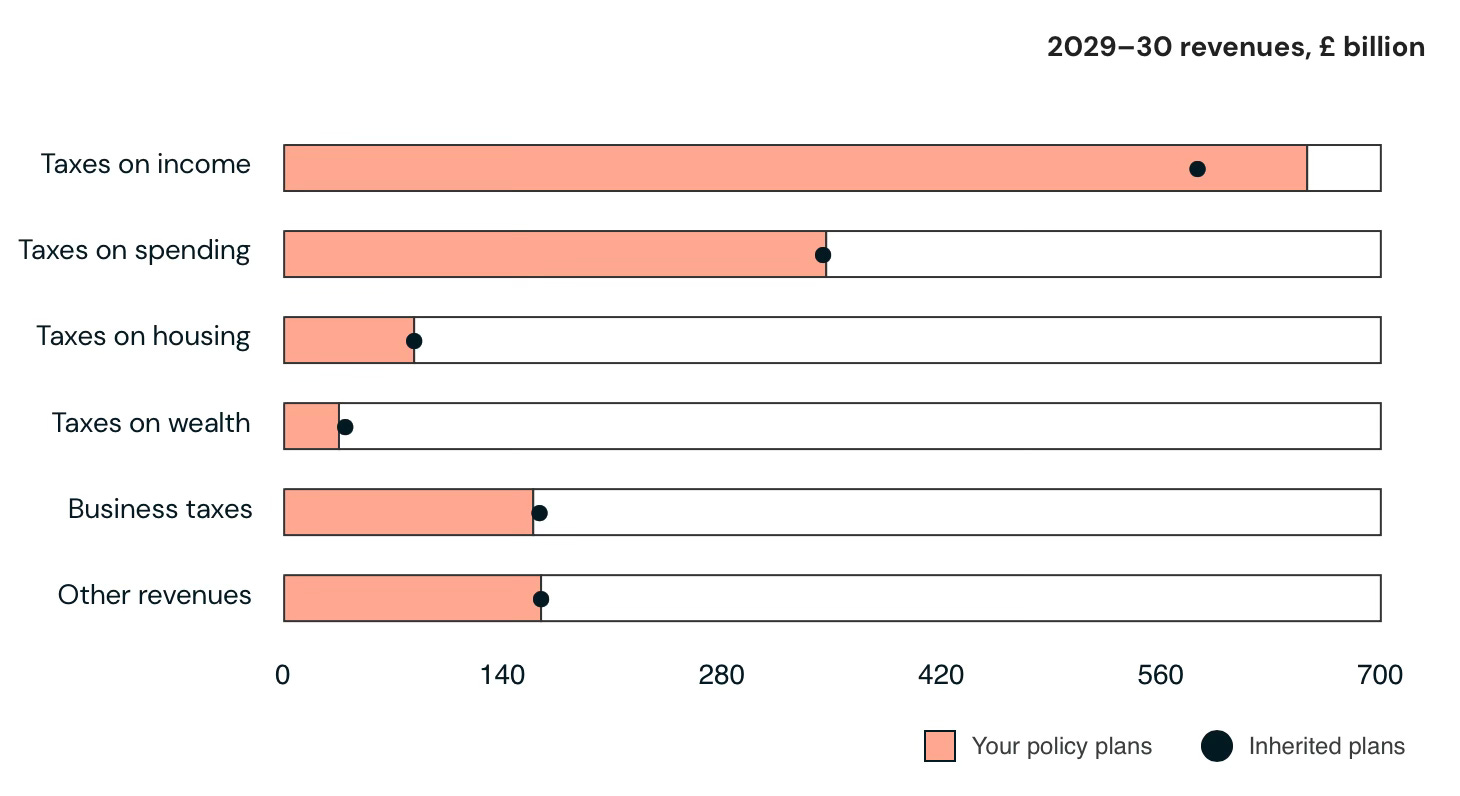

One of my dreams is to have a flat tax on income of 25% for everyone without any exceptions. The system doesn’t allow me to do that, so I change tax rates and allowances to be as close as possible as I can get to a flat tax regime. This means I increase the basic income tax rate from 20% to 25% for everyone and lower the personal allowance for tax-free income to £10,070 per year from the current level of £12,570.

I also reduce the threshold for higher income tax rates from c.£50,000 to £40,000 so more people get caught by the higher income tax rate. I also reduce this higher income tax rate from 40% to 35% (the lowest the system allows me to do) and the maximum income tax rate from 45% to 40% (again the lowest the system allows me to do).

I further re-instate the inflation linkage of income thresholds, so these thresholds increase every year and I avoid people drifting into higher tax brackets because they got a pay rise. Finally, I increase the National Insurance tax back up to 10%, thus reversing the recent cut to 8%.

In summary, this looks like a tax reduction for the wealthy while everyone else pays more but this is not true. Because the basic income tax rate is increased to 25% and starts to count at lower levels, even high-income households would pay significantly more taxes because there are fewer loopholes. Plus, to close one more loophole, I would abolish the VAT exemption for public schools (private schools for non-Brits among my readers) because it makes no sense to me that these institutions should be tax-exempt in the first place.

Meanwhile, I would try to get businesses on a flat tax regime as well, which I have done in the simulation by reducing business tax rates by 10% while keeping corporate income tax rates stable at 25%.

The result is that I would increase tax revenue by some £63bn, mostly through a massive increase in income tax revenue by closing loopholes (which is by the way why I increased spending on HMRC because we need to police taxpayers more closely, so they don’t cheat on their taxes given the higher tax burden).

So, there you have it. I would increase investments in this country and crucial spending in departments like health, education and defence, which are vital to our long-term future, something that I think most readers will support.

But if I want to do that, I need to significantly increase tax revenues, or our government debt explodes. To be precise, without increasing taxes, the government deficit in 2029/2030 would rise from £41bn projected today to £119bn and I can assure you that would trigger another market convulsion and an interest rate shock like it did under former PM Liz Truss.

And now, I challenge you to come up with a better plan to run the country. Go to the IFS website and play around with the tool. And the next time you complain about taxes and argue for lowering them, you may want to think about where you would cut spending so you don’t ruin the country.