Thought of the week – From too much research to too few start-ups

Over the last two weeks, I have used my Wednesday notes to explore the lack of productivity growth in recent decades. Last week, we saw how the amount of research produced in technology, engineering or medicine has grown enormously, but research productivity (in the sense of creating new ideas) has seen a steady decline. As I will show today, this seems to be a major driving force that holds back job creation and productivity growth in the real economy as well.

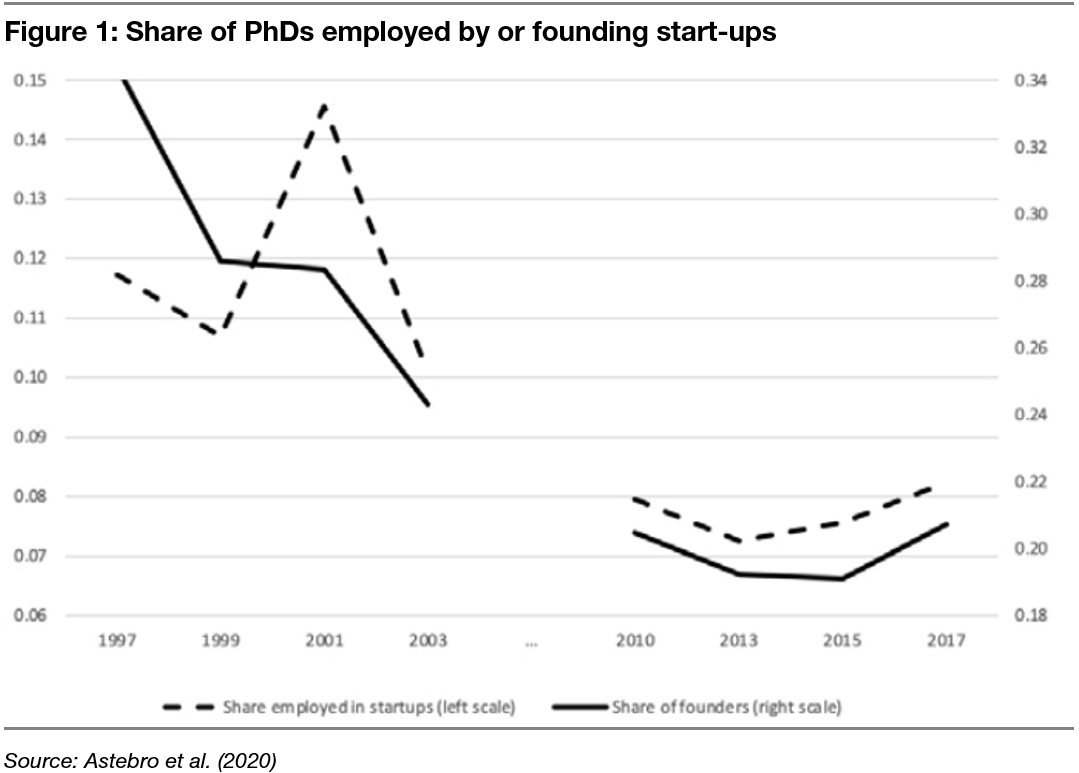

A 2020 paper by Thomas Astebro and his colleagues shows some pretty horrific statistics about start-up activity in the United States. They showed that since 1997, the share of science and engineering PhDs who go on to start a business has declined by about one-third, and the share of PhDs employed in start-ups has declined in lockstep.

This decline in start-up activity is not something that is linked to gender, ethnicity, the field of study or similar effects. Instead, the research indicates that founders of start-ups have been getting increasingly experienced before starting a business of their own. When they started their businesses, founders in 2017 had about 14% more work experience post their academic career than in 1997.

What seems to happen here is that science and engineering PhDs have to sift through more and more research to come up with ideas and need more time to accumulate the knowledge necessary to master the technology they work on. In essence, too much knowledge created in a field slows down the speed at which this knowledge is translated into real-life technological progress.

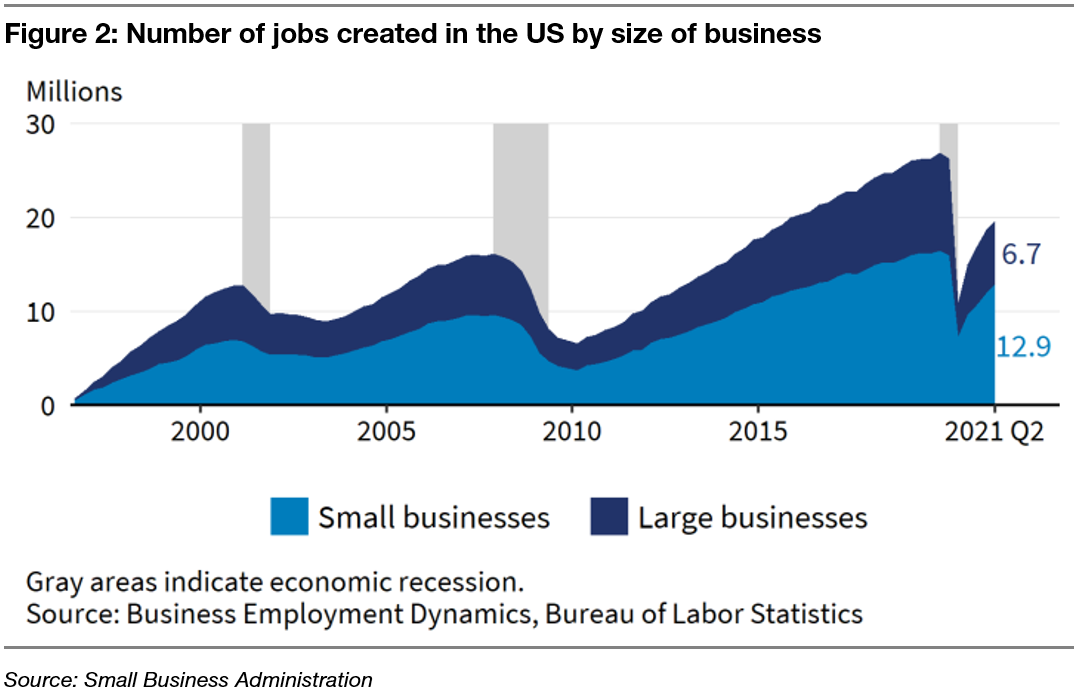

And it slows down the rate at which jobs are created. The chart below shows the number of jobs created by large and small companies in the US. Small businesses (defined as those with fewer than 1,500 employees and less than $41.5m in annual revenues) were almost twice as numerous as large businesses. Small businesses are the drivers of productivity gains and economic progress, but this driver is slowing down – not because we have too little knowledge but because we may have too much

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.