Thought of the week – Interest rates vs. earnings in 2023

A while ago, I wrote a note that claimed that changes in bond yields and inflation are much more important than changes in earnings for equity market returns – at least over shorter timeframes like 12 months.

This caused some cognitive dissonance because strategists, analysts and professional investors are mostly concerned with forecasting earnings and then deriving fair valuations for stocks from these forecasts. Throughout 2023, we will test the dominance of interest rates vs. earnings to a much more pronounced degree than usual.

Think about it this way. Soon – or rather hopefully soon – the Fed, the Bank of England and the ECB will stop hiking interest rates. At the same time, inflation will have peaked and be slowly declining. Declining inflation should lead to declining inflation expectations in 2023. And central banks that no longer hike policy rates mean that real rates should stop rising in 2023 as well. Furthermore, if the economy goes into recession, one could reasonably expect real rates to decline. Thus, it seems a fair assumption that long-term bond yields should decline in 2023.

But declining long-term bond yields means that discount rates for future cash flows will decline and this should lift share prices.

Meanwhile, if we go into recession, corporate earnings should also decline and with it the earnings expectations of analysts and investors. This, in turn reduces the expected cash flow for the next 12 to 24 months, pushing share prices lower. We are thus left with a tug-of-war between the support from lower discount rates and deadweight from declining earnings expectations.

The question of which of these forces wins depends on two things, the size of the move in earnings and bond yields and the sensitivity of share prices to these changes in earnings and bond yields.

And this is where most investors who focus on earnings instead of changes in bond yields make a crucial mistake. The earnings decline in a recession is large, but in effect it only impacts the projected cash flows over the coming 12 to 24 months. Meanwhile, the change in bond yields (and hence discount rates) may be small, but this change impacts every cash flow from today to eternity. And because, typically, more than 80% of the fair value of a company is derived from the net present value of cash flows more than five years in the future, a change in bond yields has an outsized influence on the share price compared to a change in earnings.

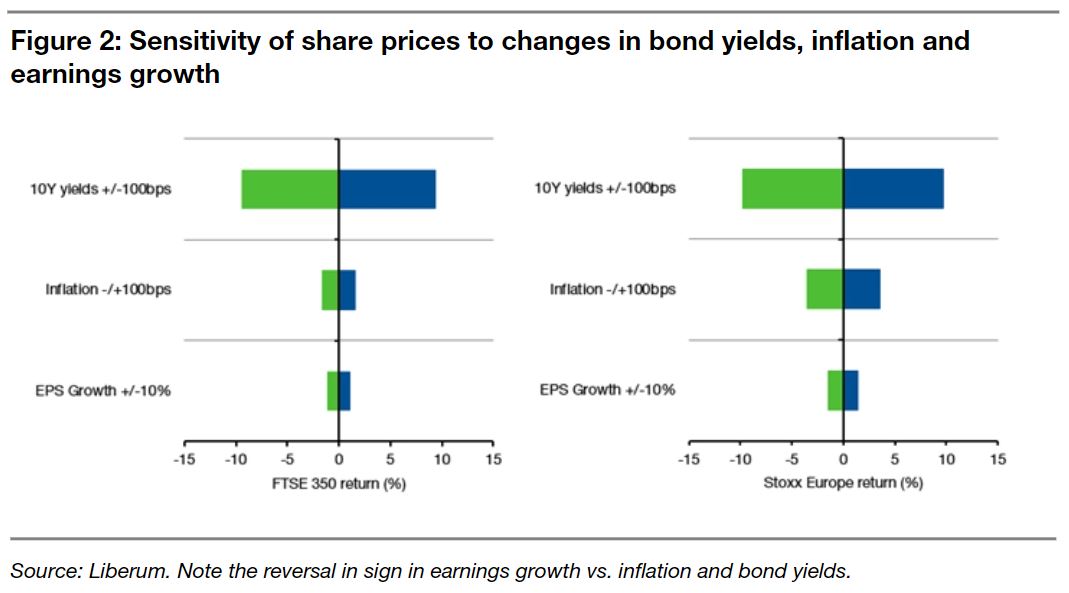

I did a little multiple regression and looked at the sensitivity of the Stoxx Europe and the FTSE 350 to changes in 10-year government bond yields, inflation and earnings per share. The chart to the left compares the impact of a 100bps change in bond yields and inflation with a 10% change in earnings. As you can see, a 100bps change in bond yields has about a 10 times greater impact on share prices than a 10% change in earnings for the coming year.

In 2023, we will likely see a drop in bond yields in the order of 100bps simply because inflation is declining from extremely high levels and central banks have pushed real yields up by so much that I think these levels will not be sustained this year. But if we get such a big drop in bond yields, earnings growth must suffer a really large drop before they can compensate for the effect of declining bond yields. And this leads us to a strange conclusion. It is possible (but by no means certain) that even if we are in recession and earnings drop a lot in 2023, share prices may go up rather than down. And that would be truly different from the typical path of stock markets in a recession.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.