Thought of the Week – Bear market investors think different

It is by now well established that investors who go through traumatic market experiences like the Great Depression or the inflation of the 1970s become permanently scarred by these experiences. Similarly, I think the market environment in which you start your career as an investor plays an important role in shaping how you invest, and a new study shows how this mechanism may work.

The research was interested in the assessment of good and bad information about stocks and how likely respondents believed, based on the received information, that a share price would go up or down. Six hundred and eighty professional investors (wealth managers, fund managers, and investment bankers) were primed with a stock chart that showed that the share price of a company was going up or down. Then new information about the company was disclosed and the investors were asked if they would buy or sell the stock, and how likely they believed it was for the share price to rise or drop.

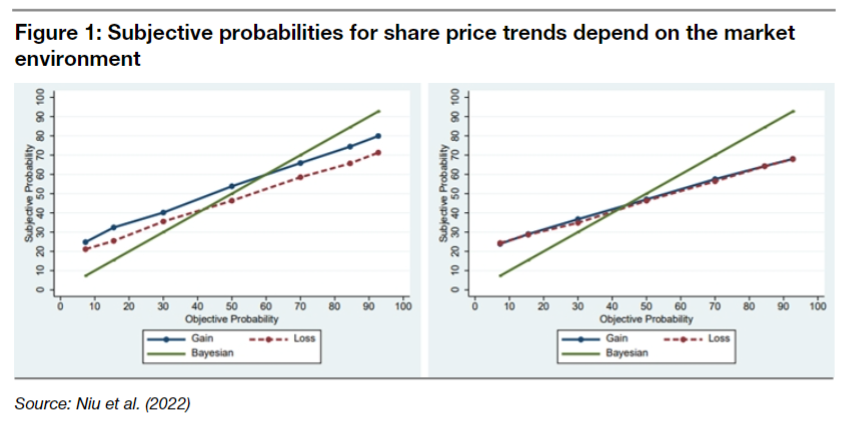

The chart on the left shows the responses of the investors to good and bad news about the stock and how likely they thought it was for the share price to rise or fall.

In the left panel, the three lines show the probability investors gave to good news leading to rising share prices and bad news leading to losses when they had been primed with a positive market environment. That is, the investors learned about the stock in a bull market. The green line, by the way, is the rational investor whose subjective assessment of the probability of gains and losses equals the objective probability.

Both the blue and red lines for good and bad news demonstrate the human bias towards putting a higher subjective probability on very unlikely events and underweighting very likely events. That is one of the reasons of why Cassandras who go on about catastrophes are so popular. They talk about extremely unlikely events as though they were likely to occur.

Note that in the left panel above, investors who learned about the stock in a bull market were systematically more likely to expect the share price to rise when good news was released than for the share price to drop when bad news was released. These investors are overoptimistic about the stock because their experience suggests that the stock rises most of the time.

Now look at the right panel, which shows the subjective probabilities associated with good and bad news for investors who learned about the stock in a bear market. The red line is practically the same as in the left panel, meaning that the subjective probability investors put on the share price going down after bad news is the same, whether they learned about the stock in a bull or bear market. What disappears for investors who learn about a stock in a bear market is the overoptimism in response to good news. Investors who learn about a stock in a bear market show no overoptimism and no inherent bias towards being bullish on the stock. This lack of overoptimism explains why investors who learned their trade in a bear market have a slightly better average performance than investors who learned their trade in a bull market, as I discussed here.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.