Thought of the Week - Language matters

You might find today’s article esoteric, maybe even ridiculous, but eight years after Keith Chen first described the influence of language on economic decisions, it is a well-established fact. Back in 2014, Chen published an article that was more than just surprising at first glance. He looked at people with different native tongues and how these languages refer to future events.

For example, in German, it is perfectly normal to use the present tense in a sentence to describe a future event. The German sentence “Morgen regnet es” translates into English as “Tomorrow rains it”. Obviously, that is not a correct English sentence. Instead, in English one should say “Tomorrow it will rain”. The use of the word “will” to denote the future is almost always necessary in the English language, but not in German. Yes, one can say in English “Tomorrow it rains”, but that would imply that the person who says it has a high degree of certainty about the weather tomorrow. Using the present tense for future events in English is typically reserved for scheduled events such as in the sentence “My flight is at 4pm tomorrow” (and note how the word tomorrow is necessary to denote the future, since leaving that word out of the sentence would change the meaning).

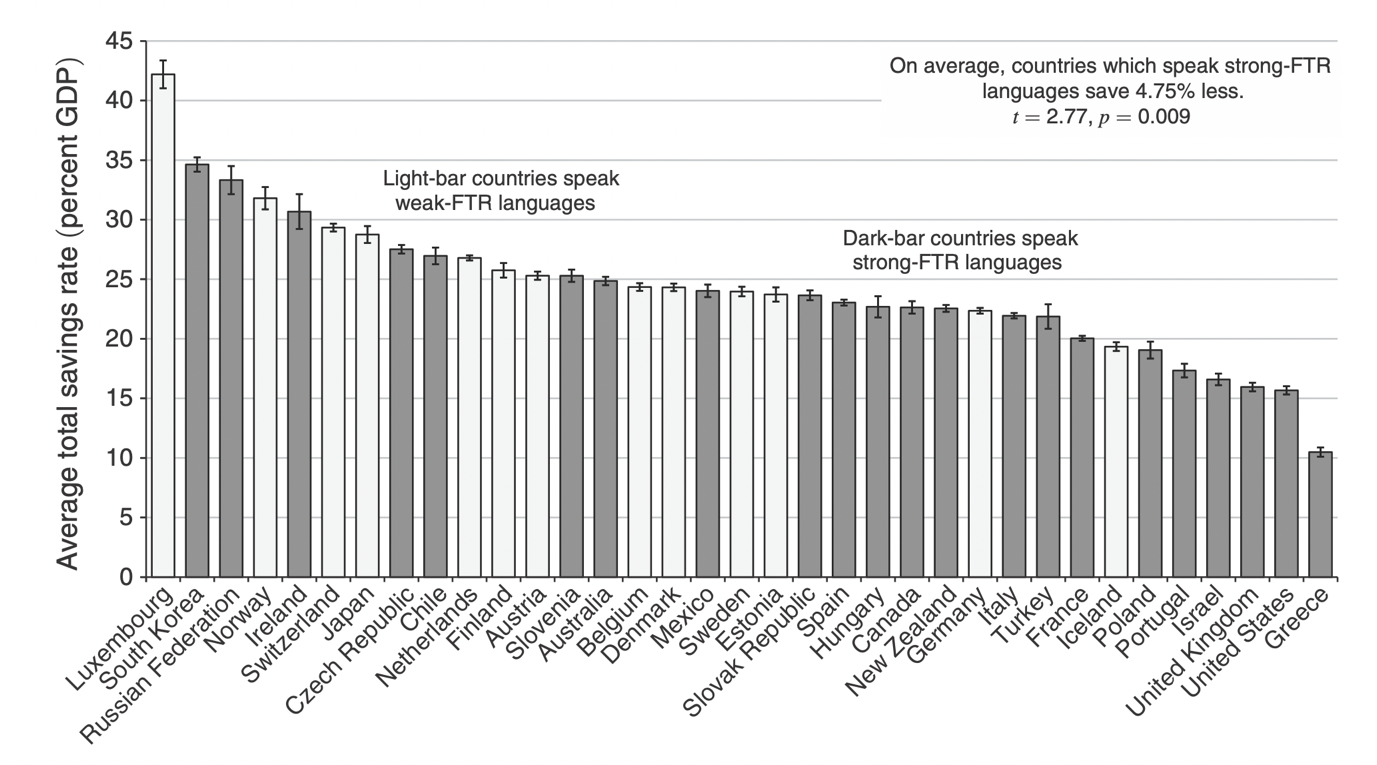

Chen’s theory was that people who speak languages that allow them to reference future events with the present tense think about the future as more immediate. Daniel Kahneman famously coined the phrase “What you see is all there is” to describe the fact that our imagination is constrained by the things we can see (physically or mentally) around us. It is similar with languages. The more immediately we can talk about the future (i.e. weak future-time reference in German), the more inclined we are to take future events into account when we make decisions today. The result is that people with weak future-time reference (FTR), like Germans, have a higher savings rate, invest more in retirement plans, retire with more wealth, smoke less and are less obese. The chart below shows the national savings rates in different countries where languages are marked by strong FTR (English, French) and weak FTR (German).

But wait, things get even better. It also matters in company boardrooms. Company directors have a job that is essentially all about the long-term future of the company. Setting strategy and monitoring progress towards strategic goals is a key task of corporate directors. And Florian Rottner has shown that boards that consist of more people who speak a weak FTR language like German as their native tongue tend to be more future-oriented. The companies they lead invest more in R&D and as a result experience a higher growth rate of intangible assets and thus total assets. Maybe there is something to cultural diversity in the boardroom!

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.