Thought of the Week - Your new beachfront property

This summer, we had so many floods all over the world that it became hard to count. But the costs to taxpayers and insurance companies are real. Aon estimates that insured losses from natural disasters worldwide in the first half of 2021 were $42bn. Then the European floods hit, which added another $2-3bn in losses to insurance and reinsurance companies. And those are just the insured losses. The true economic losses are likely to be about ten times higher than that. In the United States alone, taxpayers are estimated to have paid $99bn in 2020 for emergency relief. And 2021 is shaping up to be even more expensive.

Yet, study after study on the assets that are most at risk of floods show that investors and asset owners are oblivious to that risk. I am talking, of course, about property. You can’t move a house and if it is too close to the ocean or a river, it will inevitably flood after heavy rainfall or as sea levels rise. Yet, a year ago, Justin Murfin and Matthew Spiegel examined sales of coastal properties in the United States and their proximity to flood areas and vulnerability to sea level rise. The result was that they didn’t find a result, i.e. they could not see any difference in house prices between properties at higher risk of flooding and properties at a safe height. There seems to be a political effect, though, with Democrats and Democrat-leaning voters moving away from flood plains and coastal properties and Republicans and Republican-leaning voters moving in. People who don’t believe in climate change are happy to buy beachfront properties while people who take climate change seriously move inland with the expectation that in 20 or 30 years, their houses will have become beachfront property. In the United States, at least, the net effect is that more and more people move to coastal regions.

And it seems that moving inland or to higher ground makes a lot of sense. A new study by Claudia Tebaldi and her colleagues estimated that coastal properties are so vulnerable to sea-level rise that a once-in-100-years flood will start to occur every year. This study piqued my interest because, while my house is located in a once in-500-years flood zone in London, I am just one block away from a once-in-100-years flood zone. So, if the study is correct, not only will I have a much shorter walk to the riverfront, but I should expect much higher premiums for my flood insurance.

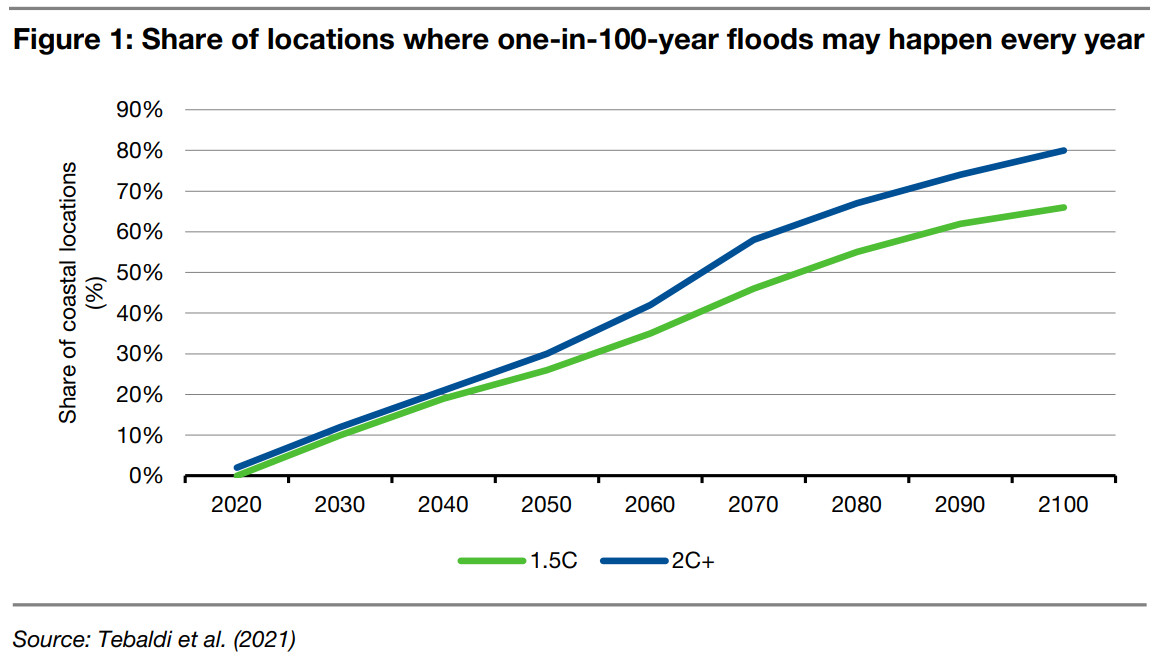

In any event, the chart below shows that even if we manage to keep global warming at 1.5C above pre-industrial levels, in 2030 about 10% of properties worldwide will experience a once-in-100-years flood event on average every year. By 2050, this will have risen to 26%, and 66% by 2100. If we can’t keep global warming below 1.5C as seems highly likely right now, then we have to expect that by 2100, 80% of houses will be exposed to a 100-times greater flood risk than today.

Ignoring the societal consequences for a moment, this has significant implications for investors. First, they need to check where the property investments they buy are located. REITs with lots of coastal properties will likely experience a larger loss in value and income from natural disasters than the average REIT and this higher risk is currently not priced into these assets. Second, if you think about buying a house, please take flood information seriously. You are likely to live in your house for a long time and over time, it will become increasingly likely that flood-prone locations will sell at lower prices than safe locations. If you consider your home a form of investment or retirement savings vehicle, sea-level rise can no longer be ignored as a risk factor.

And finally, should you live in an area that is at risk from rising sea levels, you might want to develop an exit plan where at some point in the future you sell the house before these risks become priced in.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.