Thought of the Week - What do people think about sustainable investments?

One of the more common questions I get from readers is whether people who are fans of ESG investments are willing to give up performance. I have argued here why I think this argument is flawed and shown here that, in practice, there is no trade-off between sustainability and returns. Apart from that, you can read here that investors are willing to give up quite substantial returns for the privilege of aligning their investment choices with their values.

But there is also the human tendency of motivated reasoning. If you invest in sustainable investments, you start to believe that these investments have higher performance. Or is it the other way round? That is what I was asking myself when I read the results of a new survey of investors.

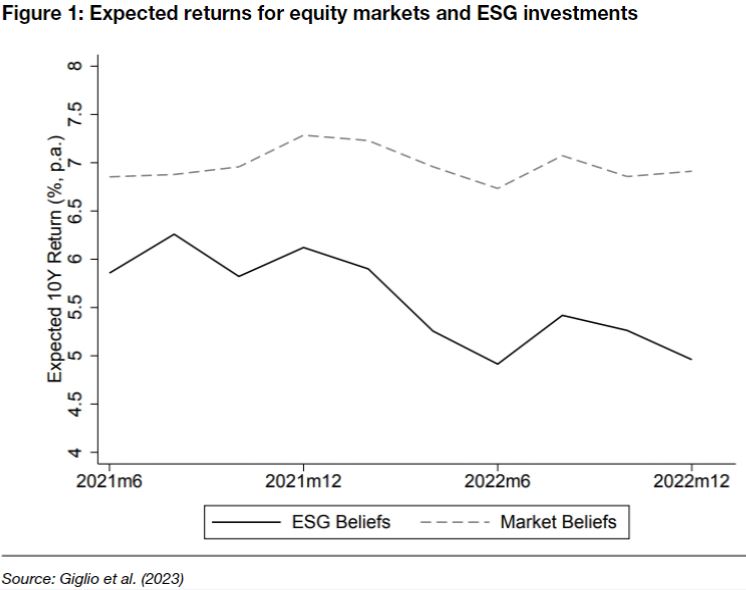

The survey asked some 18,000 US retail investors what they thought about ESG investments and why they invested in them. One of the key outcomes was that, on average, investors think that ESG investments will have substantially lower returns over the next 10 years than the market. And notably, with the advent of the Ukraine war and the subsequent rally in energy prices and energy stocks, the gap between expected returns for the market and ESG investments widened a lot.

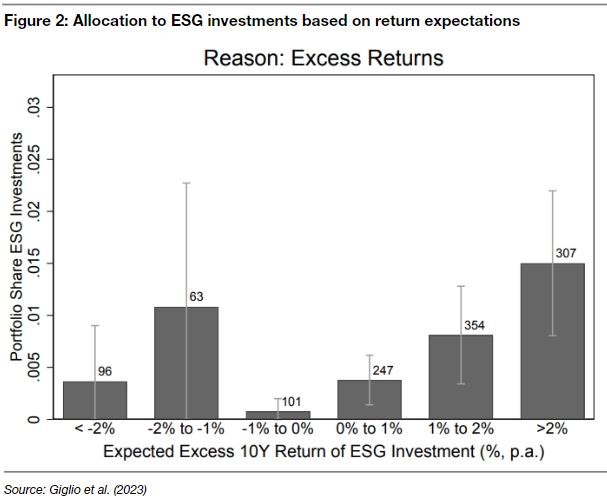

But just because the average investor thinks that ESG investments have lower returns doesn’t mean they will not invest in it. The chart below shows the expected return difference between ESG investments and market returns and the share of ESG investments in the portfolio of these investors. To nobody’s surprise, investors who think that ESG investments will substantially outperform the market had higher allocations to ESG. But note that the second-highest allocation to ESG investments was found in people who thought these investments would underperform the market by 1-2% per year. This gives you an indication of how much performance some investors are willing to sacrifice.

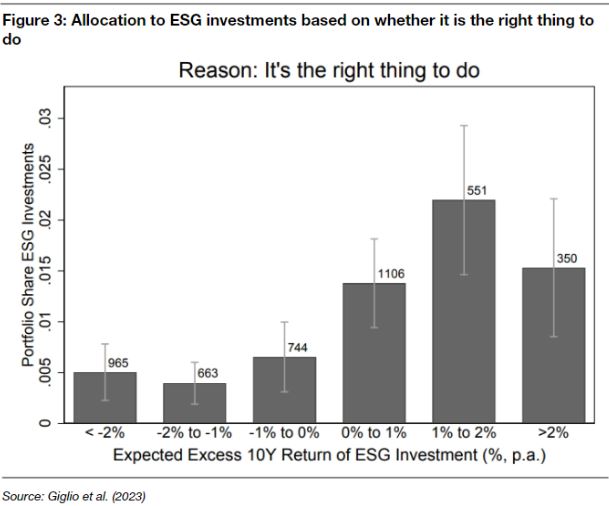

But look at today’s final chart below showing the beliefs of people who invest in ESG assets not for return reasons but because it is the right thing to do. Higher allocations to ESG investments go along with higher return expectations. If it is the ‘right thing to do’ why should ESG investments outperform the market? In my view, the chart is plotted the wrong way around. Instead of showing the allocation as a function of the expected return of ESG investments they should have plotted the expected return of ESG investments as a function of portfolio allocation. Because, I suspect, many investors first decide to invest in ESG because ‘it is the right thing to do’ and then, when asked about their return expectations for these investments provide an overly optimistic answer.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to [email protected]. This publication is free for everyone.