The UK stock market concentration problem

For the last couple of years, investors have bemoaned the rising index concentration in the US. Thanks to the strong performance of US technology stocks, they now account for roughly 35 per cent of the S&P 500 index and 28 per cent of the MSCI World. If US technology stocks drop, so does the US and global stock market.

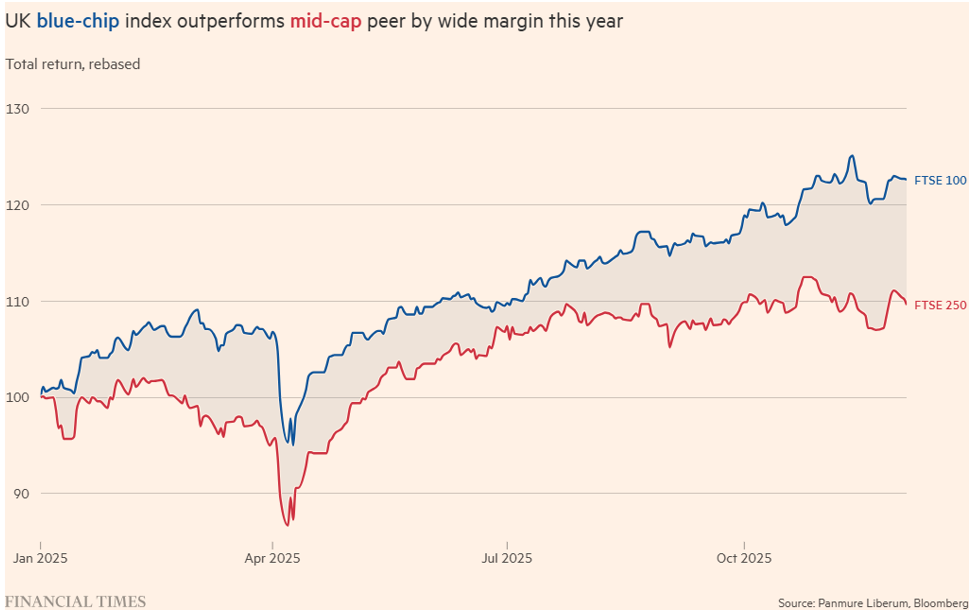

But the UK stock market, though much less exposed to technology stocks than the US, has its very own concentration risk. To see this, all we need to do is analyse the performance gap in total returns between the FTSE 100 and the FTSE 250, which has been particularly large this year at 13 percentage points. I find that this gap can almost entirely be explained by two sectors and just six stocks.

There are considerable differences in sector weights between the FTSE 100 and the more broadly diversified FTSE 250. Usually, this benefits the FTSE 250 since the broader diversification should reduce risks more effectively. But if stock market performance is highly concentrated in a few sectors and stocks, this works against the FTSE 250.

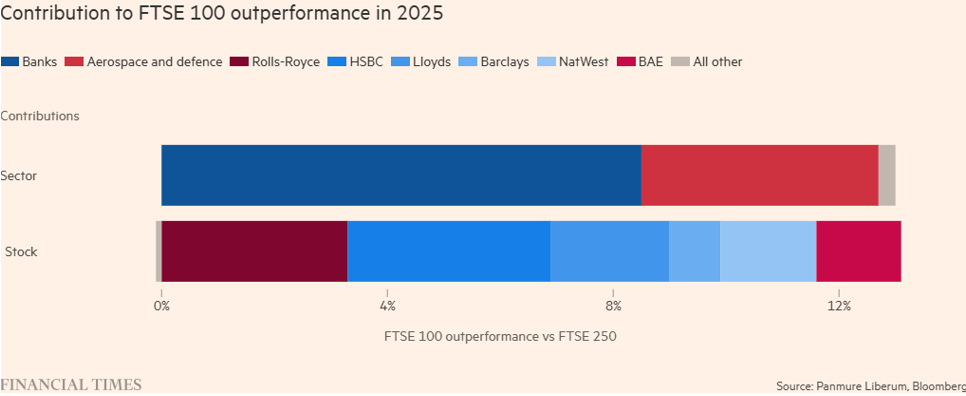

In 2025, outperformance has been highly concentrated among bank stocks and aerospace/defence stocks. These two sectors have a much larger weight in the FTSE 100 than the FTSE 250.

If you combine the larger weight in the index with the strong performance in 2025, we can explain 8.5 percentage points of the 13 points performance difference between the FTSE 100 and FTSE 250 this year with the bank sector. Another 4.2 points came from the aerospace and defence sector. Without these contributions, the FTSE 100 would have outperformed the FTSE 250 this year by a mere 0.3 percentage points.

On the single stock level, it gets worse. Rolls-Royce alone contributed 3.3 points to the performance gap, even though it is only the fifth-largest stock in the index. Lloyds Banking Group is 13th, but contributed 2.1 points to the performance gap. Add a couple more banks and defence stocks, and again, we can explain all the outperformance of the FTSE 100.

Investors in the FTSE 100 might not care about this narrow leadership, given the strong performance after so many years of poor returns compared with the US. What this analysis shows, however, is that if the rally in banks or defence stocks stalls, the FTSE 100 may quickly become an underperformer again.

In defence stocks, the current boom looks likely to continue for several years as Europe re-arms. But what about the strong performance of banks? Banks currently benefit from record profits, which are to a large extent the reflection of higher interest rates and a steeper yield curve, which increases lending margins. But, if anything, the Bank of England is in the process of lowering interest rates, and the yield curve started to flatten in September and October before Budget worries negated this trend. But now the Budget is behind us, and the growth outlook for the UK is not particularly strong. Gilt yields could start falling again, creating substantial headwinds for bank stocks in 2026.

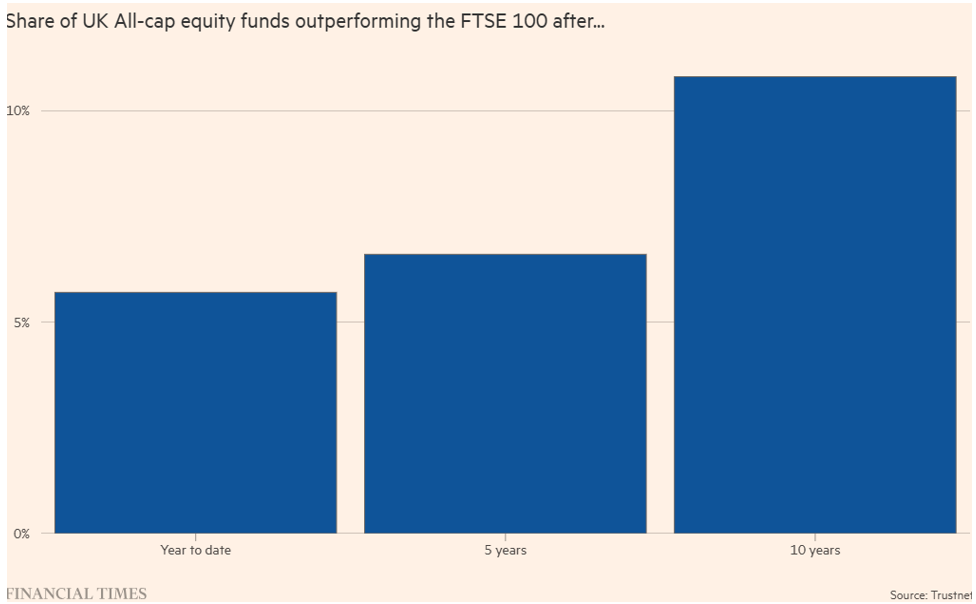

On the other hand, I am not even that sure many investors have fully participated in the FTSE 100 boom in recent years. The narrow performance leadership makes it even harder than usual for active fund managers to outperform the index. Since the inflation spike in 2022, performance leadership in the FTSE 100 has been very narrow, limited essentially to banks, oil and gas, and defence stocks.

The result is that, according to the database in Trustnet, only around 10 of 210 UK All Companies equity funds managed to outperform the FTSE 100 after costs this year. Over the past five years, it was even worse, with only 14 of these managing to beat the index. Over the past decade, things have got a little bit better, with 23 of 210 funds managing to beat the FTSE 100 after costs.

In this environment, the strongest performing funds will be the ones that pick the one, two or three stocks in the index that drive most of the performance. The managers of such funds will no doubt be skilled but good fortune — even luck — will not be an insignificant factor.