California Wildfires: Analyst View - Abid Hussain, Insurance

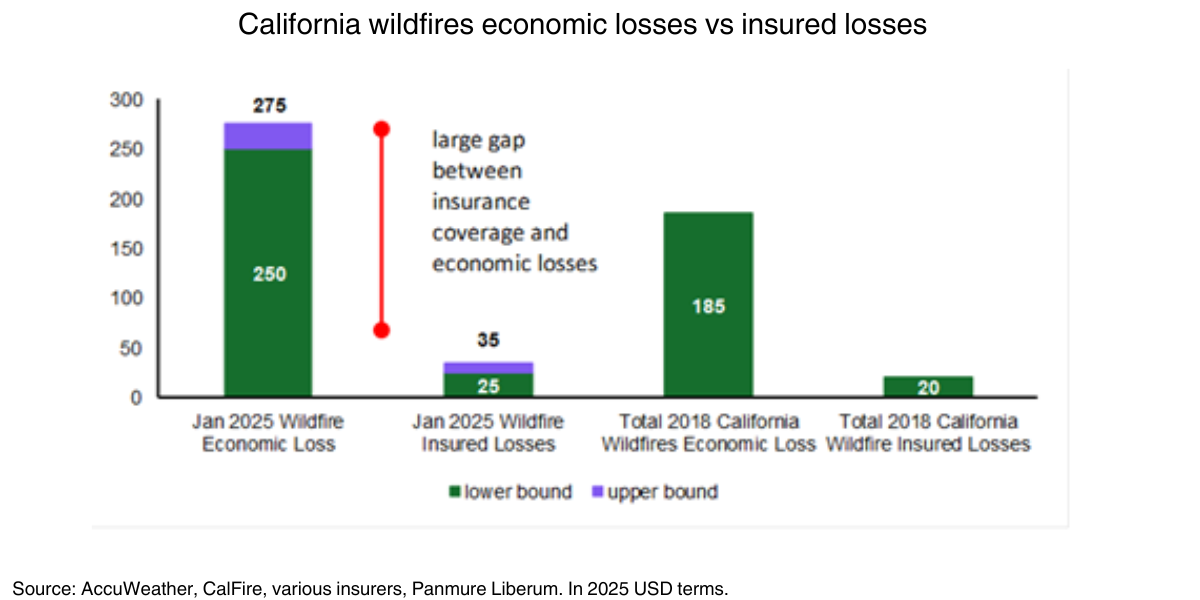

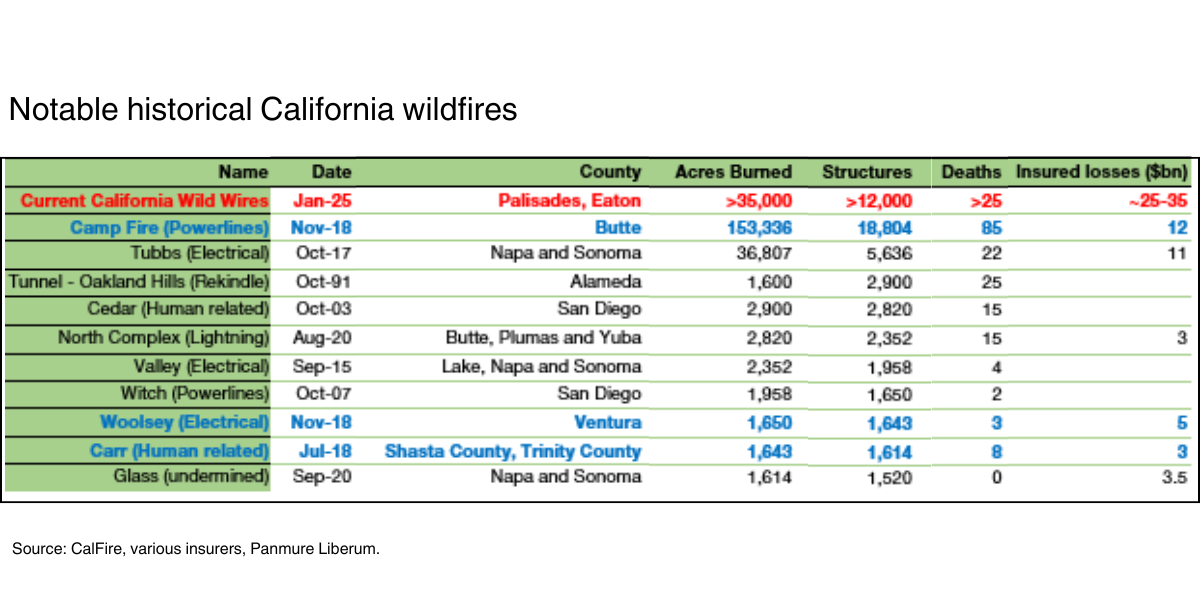

As California wildfires continue to develop, Panmure Liberum updates its economic and insured loss estimates. The economic losses are likely to be the largest on record for the state at c.$250-275bn. This compares to a total of c.$185bn economic losses across all of California’s wildfires in 2018.

The proportion of insured losses is significantly lower compared to the total costs of rebuilding and rehousing, as many properties are underinsured or lack insurance altogether. We estimate that insured losses will range between $25-35 billion, an increase from last week’s estimate of $20 billion, as the fires continue to devastate the LA region.

To provide further context, the current insured loss estimate not only exceeds the $17bn insured loss suffered from the November 2018 California wildfires, which had set the previous record, but also the total $20bn insured losses resulting from all the 2018 Californian wildfires. Whilst fewer acres and structures have been destroyed, the insured losses are higher as the devastation has struck areas with higher property, content and rehousing values.

The current wildfires will rank among the top ten insured losses from natural disasters worldwide if they come in at the top end of our loss estimates. For context, the 1994 Northridge earthquake in the U.S. incurred costs of approximately $34 billion in today’s prices, while the costliest event remains Hurricane Katrina in 2005, with insured losses reaching $108 billion.

Whilst there are no disclosures or sensitivities provided by the companies for wildfire losses, the coverage levels have been reduced recently and so the wildfire losses are likely to be lower. In fact, the ongoing California wildfires, whilst devastating, are not considered extreme loss events by insurers, as they occur relatively frequently. We estimate this wildfire to be a 1-in-20 or 1-in-30-year event. It is important to note that whilst the insured losses may appear large, insurance premiums in areas which are prone to wildfires, have already seen an increase of 7-16x in premiums since 2015. This reflects the increased risks from natural catastrophes and, in particular, wildfires. In fact, many insurers have exited the market or excluded cover from wildfire.

If the industry losses are c.$35bn, we think the individual losses will still be manageable. But if the industry losses are above this, we understand that retro insurance programmes, i.e., reinsurance for the reinsurers, are likely to kick-in to spread the losses across a broader array of insurers.

The London-listed global specialty insurers and reinsurers’ share prices seemed to have had some of the worst reactions to the developing wildfires, with share prices down 6% since the fires broke, before recovering to end this week down only 1%. The large European reinsurers Munich Re, Swiss Re, Scor, and Hannover Re have ended the period up 1% on average, whereas the US P&C insurers and US-listed speciality insurers’ share prices have suffered, in particular, Everest Re, Fidelis, Bowhead, RLI, Travelers, Chubb, and Allstate. We think most of the insured losses will sit with local primary insurers followed by nationwide primary insurers, with spillover into the reinsurance markets.