Bond yields: Analyst view – Abid Hussain, Insurance

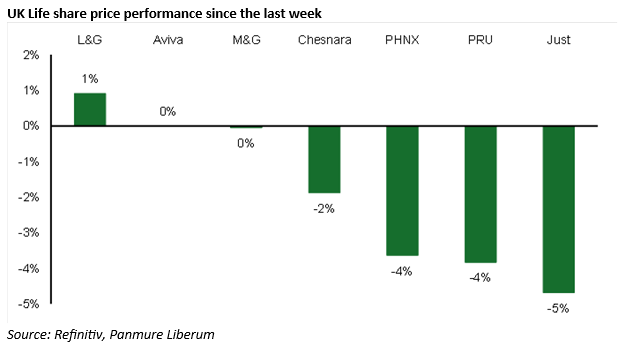

We think it is timely to cover the movement in the UK Gilt yields given the material increases over the first ten days of the year, before a material decrease in the past two days as inflation data has come in better than feared. UK Life Insurance stocks have been reacting negatively to the rise in 10-year bond yield, with UK Life Insurance stocks down by 2-15% since last week, following the c.25bps upward swing in 10-year UK government bond yields, which represented more than a 2-standard deviation move in yields over any weekly period since 2005.

We always find this market reaction at odds with the fundamentals. However, the market does not trade on fundamentals in the short-term. The Life stocks tend to behave like bond proxies in the short-term, even though higher government bond yields are positive for investment income over time. In addition, the market tends to focus on the asset side of the balance sheet in the short term and incorrectly worries about the fall in bond values following such a move. There are no real cash flow concerns or asset-liability matching concerns.

The UK Life companies tend to buy and hold most of their bond portfolio to maturity to match their liability profiles. There is, of course, tactical trading around the edges.

The market may also feel the difference between the dividend yields these stocks offer (ranging between c7-10% prior to last week’s moves) to maintain a minimum spread above the 10-year risk-free rate. Either way, the reality is that their balance sheets immediately improve, and investment income improves as they reinvest their maturing bonds at the higher prevailing rates. Interestingly, as bond yields have moved up over the past two days, following better than expected inflation data, we have seen share prices make up some of their earlier losses.

Gilt yields are now at 4.65%, following a multi-year peak of 4.89%, a level last seen in 2008.

In general, UK Life insurance companies have very strong balance sheets. In fact, nearly all UK Life companies’ balance sheets are positively geared to rising interest rates and we are therefore optimistic for the UK Life Insurance sector.